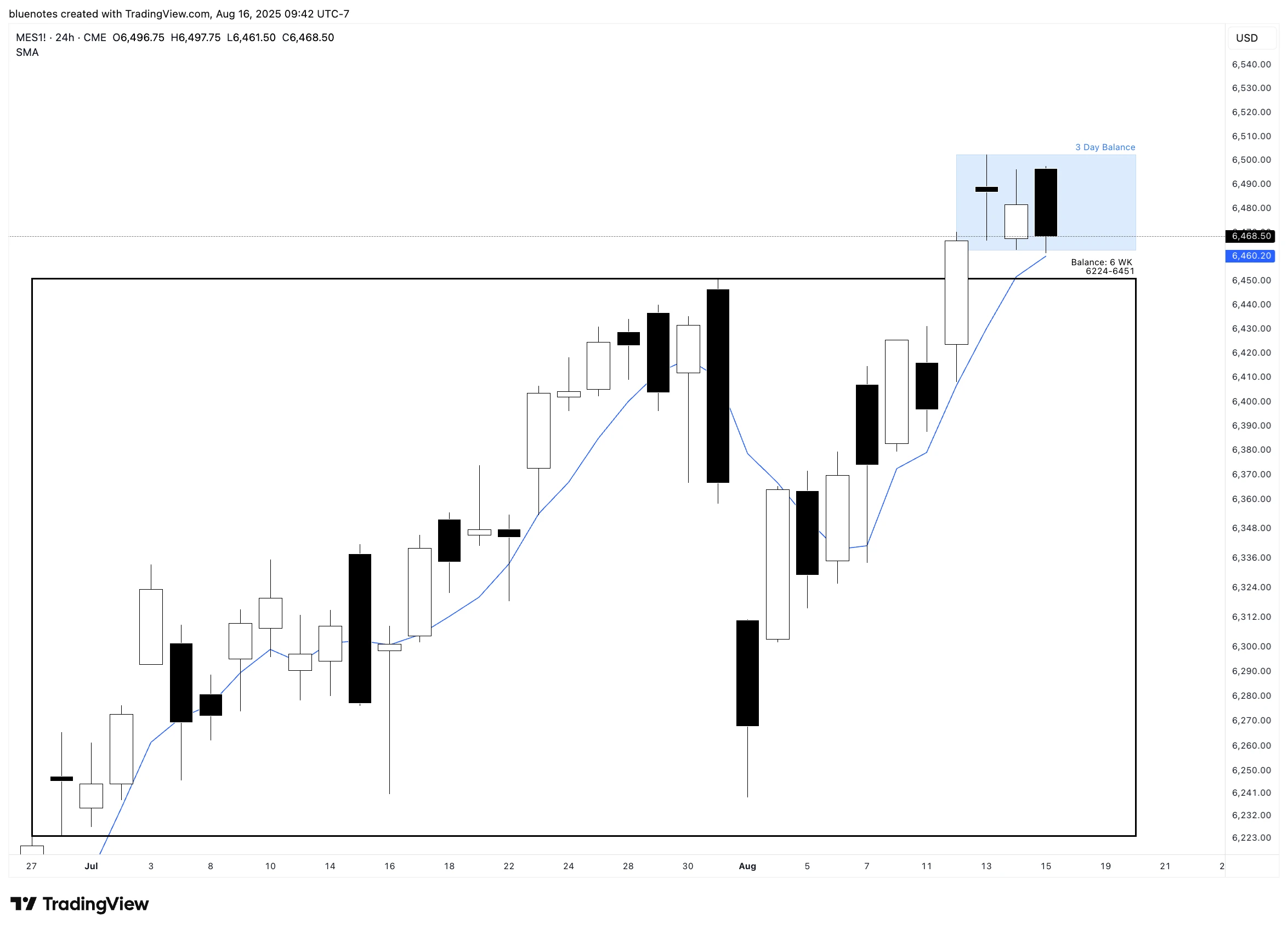

This past week delivered the long-awaited breakout of the six-week balance on ES, continuing the pattern of higher highs and higher lows while building value higher. That said, the follow-through has felt somewhat lackluster. Bulls may simply be showing fatigue after such a strong, direct move off the balance lows. It’s not ideal to see a fresh three-day balance form immediately after a breakout, yet that’s exactly what ES has done.

Meanwhile, NQ showed early warning signs mid-week, fading into weakness through Friday. In contrast, YM helped carry ES to new all-time highs Friday morning, with both YM and ES posting overnight ATHs. It’s worth noting that weakness can creep in even without a “good” RTH high but the burden of proof still rests with sellers. They do have a window here, but plenty of bear traps remain below.

NQ once again produced multiple excess highs and remained soft into the weekend. ES’s structure, however, is less concerning. While Friday’s candle on ES looked uncomfortable in isolation, it may simply represent a 3-day balance consolidating above Tuesday’s breakout and the rising 5-SMA.

With ES already making a new ATH overnight, the unfinished business now lies with RTH. A proper RTH all-time high would “clean up” that overnight print. For sellers, the best opportunity would come with a clear excess high. Until then, buyers remain favored, as value continues to migrate higher.

As long as the 6430–6460 zone holds, even with a look below and fail (LBAF), my expectation is for RTH to eventually print a new all-time high. This will be my primary setup for the week.

I briefly mentioned this scenario on Thursday.

The ETH excess from before was cleaned up as RTH made a new ATH yesterday. NQ has two excess now and price is struggling. This doesn’t mean blindly short. But I think if we end up closing down into the lower distro on the weekly today or tomorrow, then you’ll have a nice LVN to play against on the short side later on as a backtest. However, closing in the upper distro opens further prices north as dip buyers will continue to buy below 6460. RTH didn’t even get a chance to buy the pre market low yet.

The pre market low for reference was the PPI event candle low which was a test of the 6 week balance top 6251-54. And as a reminder that the single print is still unfilled there (6454-54.75).

6451 (prior 6-week balance high):

Losing this area could open weakness, though it doesn’t neatly qualify as a LAAF given the heavy volume built above. It’s still worth keeping the broader six-week balance in mind as there is potential to see the bottom of it, but I’ll avoid assuming a full rotation lower without fresh evidence.

6430–6460:

This is the main battleground. A LBAF of 6460 would represent a trap of both the current 3-day balance and this week’s upper distribution, creating a favorable swing long setup targeting a return to balance and potentially a new RTH ATH. Any longs from below here need to respect the LVN between the two distributions, which could act as resistance if offered from below. Acceptance below 6460 here suggests rotation back to 6431–6435.

For sellers to gain traction, they need to produce a series of lower highs and lower lows below 6431 and last week’s low. Only then does the potential for an intermediate timeframe trend change emerge. Until that structure develops, dips remain vulnerable to being bought.

The market is showing early signs of fatigue, particularly with NQ lagging, but ES continues to build higher value and has unfinished RTH business at new highs. As long as 6430–6460 holds, I expect buyers to remain in control with the potential for new RTH all-time highs. Sellers have a chance here, but they’ll need decisive structure—and ideally a failed breakout—to flip momentum.

ES Live Chart: https://www.tradingview.com/chart/f8EEzTyy/