The bulls showed up in force while I was away, and the bigger picture hasn’t changed much — we remain OTFU across higher timeframes, grinding toward the upcoming FOMC rate decision. That said, we do need to stay cautious with this week’s event risk. A quick reminder: there’s no directional short until at least a prior day’s low is taken out with follow-through, and ideally a prior week’s low as well. Until then, we continue to look for higher lows as buying opportunities. Still, the rate decision could set up a “sell the news” reaction, especially with late-September seasonality often turning bearish into October.

This week is packed with catalysts: FOMC, VIX expiration, quarterly OPEX, and ES/NQ contract rolls. I do not back-adjust my charts, so starting Monday I’ll be trading December contracts (Z25), which are carrying ~58 points of premium over September.

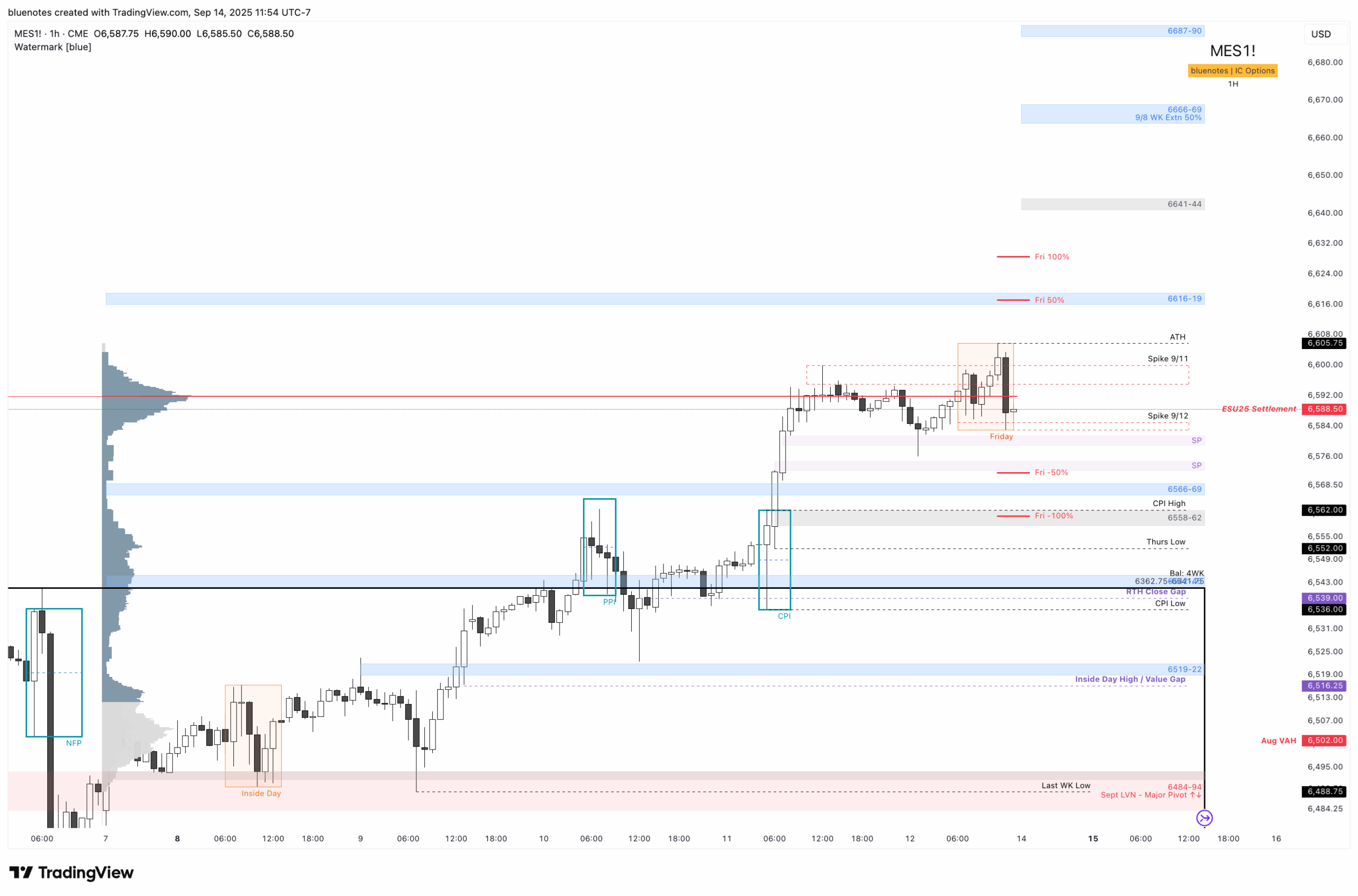

Last week we broke above the 4-week balance (6362.75–6541.75) and held the balance top through both CPI and PPI. Ideally, buyers want to remain above 6541.75, which also lines up with the weekly level 6542–45 (6597–6600 on Z25). Building value above this area will help confirm the breakout. Bulls should also defend last week’s low at 6488.75 (Z25: 6544). A break and acceptance below there would begin to unravel the breakout, opening up downside rotations, though I’d still be looking for a higher daily low to reset the trend.

For this week, I’ll use Friday’s range (6583–6605.75) as a guide. Friday’s low was marked by a spike down at 6583–6585 with a single print just below (6579–6581.50). The high includes the RTH all-time high.

Trading Higher:

The path higher remains straightforward until, at a minimum, a prior day’s low is taken out during RTH. Expect continued low-volatility grinding action, which means caution on rips but looking to buy constructive dips. If FOMC is a “sell the news” event, the grind may extend into and just after the announcement, with selling pressure showing up a session later (as has happened in the past).

Acceptance above Friday’s high would target the 50% extension and weekly level at 6616–19. Any pullback from there should ideally find support back at Friday’s high and the Sept. 11th spike. Further acceptance opens 6641–44 and then 6666–69, which also marks the 50% extension of last week’s range. The weekly expected high sits around 6664.

A bearish scenario on strength would be a look above last week’s high that fails back inside the range — but this doesn’t matter until, at minimum, a prior day’s low is taken out.

Trading Lower:

Just below Friday’s low and spike down sits the single print at 6579–6581.5. Losing this area opens rotations back into Thursday’s range to continue repairing structure. Globex started this cleanup Thursday night, but RTH has yet to do so. Acceptance below the single print would likely drive price toward 6566–69, then 6558–62, testing the CPI and PPI event highs.

Taking out Friday’s low would shift the daily into balance, inviting more two-sided trade. Above the 4-week balance top, I’ll continue to look for a higher daily low to get long. Once in balance, the focus shifts to engaging at the edges. Acceptance below the 4-week balance top (6542–45) would open further downside toward 6519–22 and 6492–94.

⸻

That’s about it for now. The contract roll will make levels tricky to navigate unless you convert to Z25, so I’d suggest also keeping a close eye on SPX for cleaner balance references and LBAF/LAAF setups.

ES Live Chart: https://www.tradingview.com/chart/f8EEzTyy/