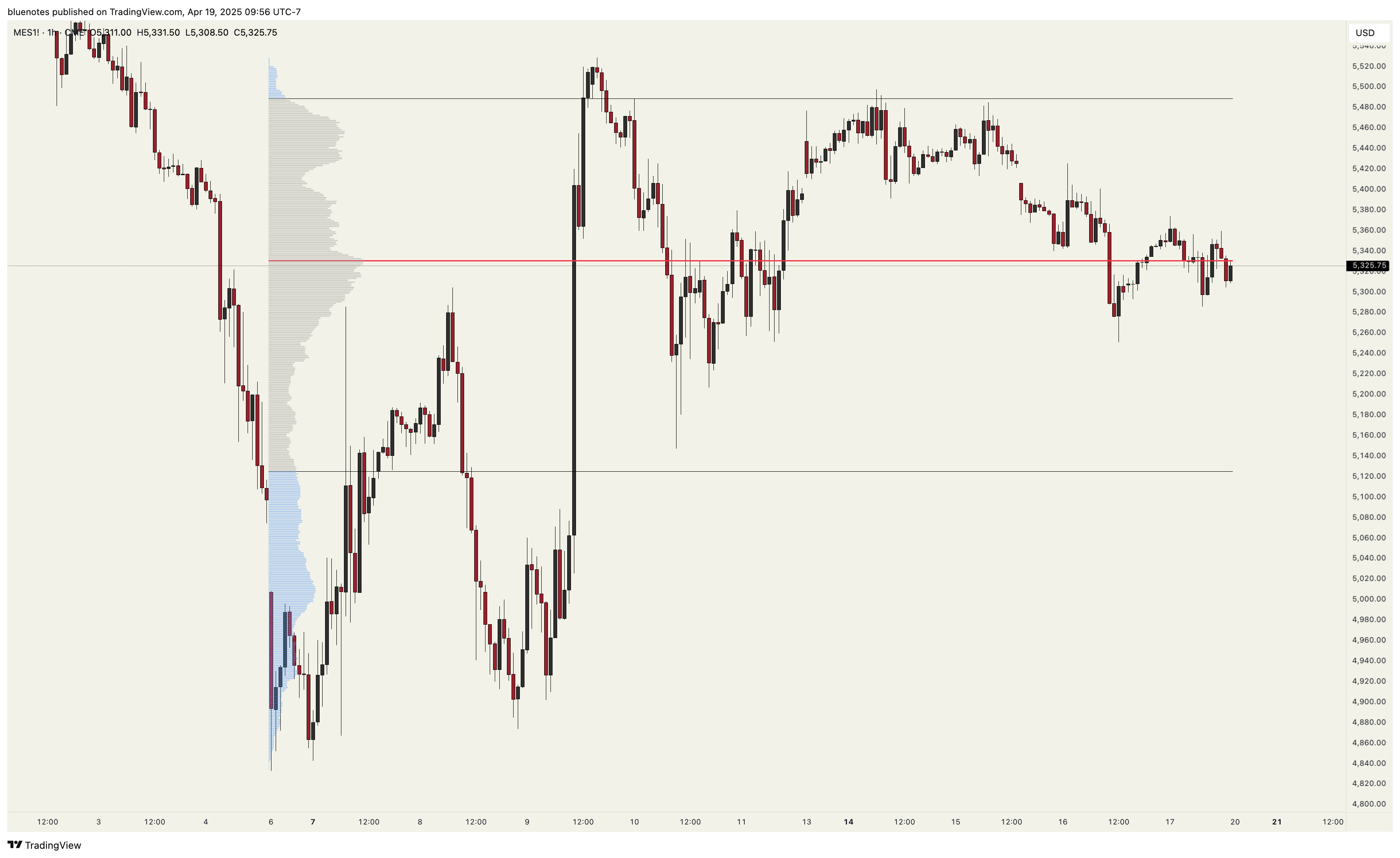

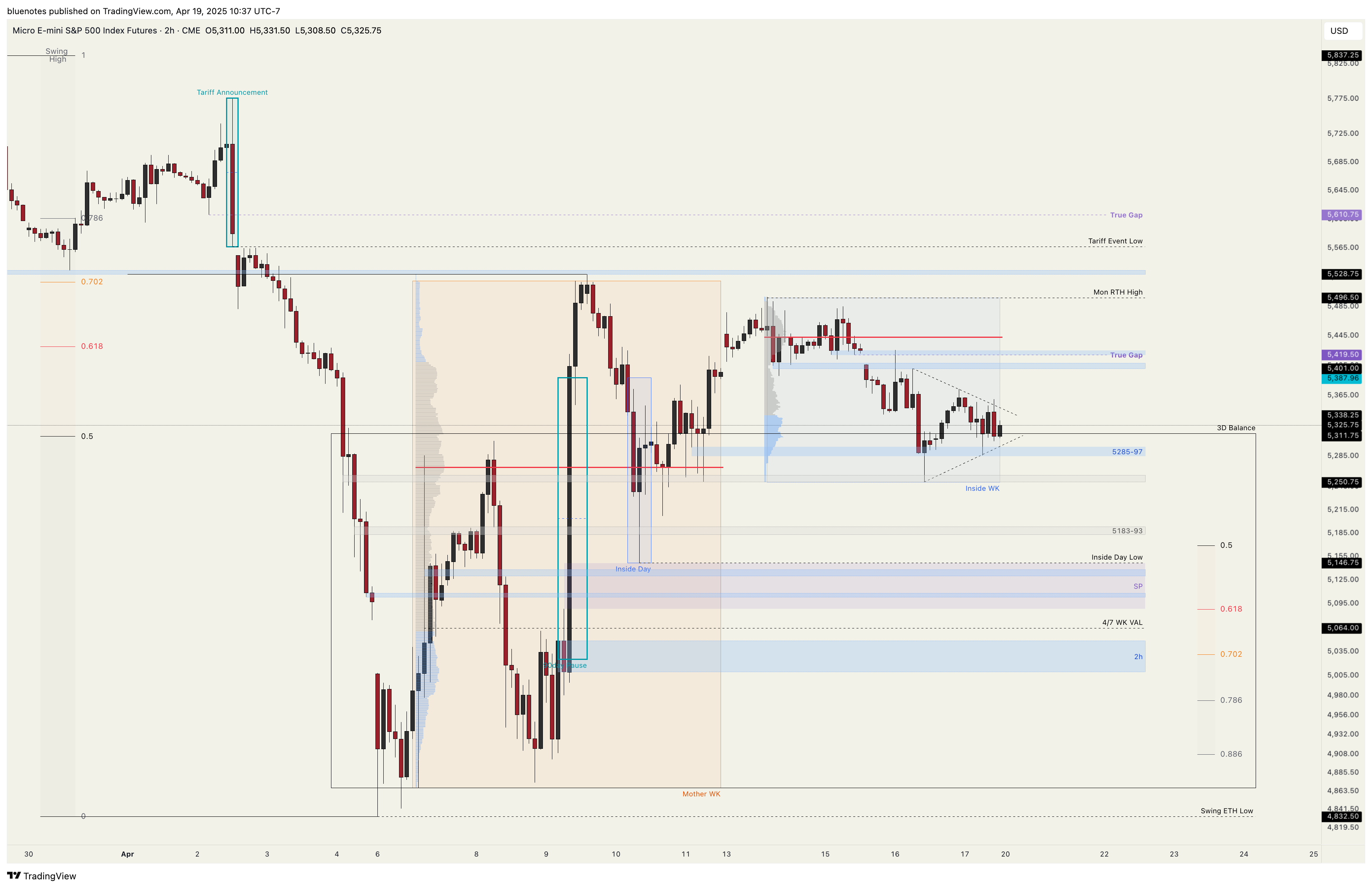

I’ve mentioned previously that the current low may not be the low. What bothers me is the volume profile since then. The low is not at a bad location, it’s at an important level an area of the 3-year breakout. But the amount of volume that is top side verses lower is what bothers me. What I’m referring to is accumulation. Was it enough time to allow larger buyers to accumulate new positions in equities which would then give greater support later. Remember we spent multiple months in distribution and only a week at the current lows.

With last week being an inside week and RTH not able to trade above the weekly open, this leans me to still be bearish and remain cautious of any new swing longs. I am not a trader that will typically short and would rather wait for solid long opportunities even if being a day trade. Focus on your strength and not react at every moment the candle flips. I always wait for the price to come to me and if it doesn’t so be it.

This week is pretty simple to plan. Just like an inside day plan, an inside week is treated the same.

The close on Thursday sits on the 3 day balance top. A break of this past week’s low with continuation opens a possible retest of the prior lows. It is of course possible that we end up with a LBAF week that closes back in this week’s range. We therefore need to be prepared to remain flexible with our bias. So while I lean bearish for now, it is with the expectation of further accumulation and a higher low opportunity.

5401-08 would be key for sellers where as 5420-25 would be key for buyers. Last week’s vwap is sitting at 5389.23 with Monday’s RTH low being 5391. If sellers defend 5401-08 then it’s reasonable to remain with a bearish lean. They would need to heavily defend this and not allow much traction above. The true gap sits at 5419.50 where ETH did explore with a heavy rejection; therefore, if buyers manage to get back above and hold say 5401 as support then last week’s high comes into play including the prior week RTH high 5519.75. Continued acceptance above would then target 5554-60 and the Tariff event low 5566.50. Further acceptance can see the gap fill at 5610.75.

Breaking below last week’s low 5251-60, opens the inside day low which has not been tested yet at 5146.75. This is where the remaining single print remains which won’t be fully filled until 5088. There is a good potential for a LBAF of the inside day low which could venture towards 5130-38 before happening. On a larger picture, if this holds and reclaims 5285-97 would be pretty bullish. The single print low also sits around the 618 fib since the swing low and current swing high which coincides with the halfback of the 3 day balance. At this point, failure to reclaim or hold the single print or the inside day low at 5146.75 allows rotation into the prior week’s low and 3 day balance low.

Trapped below 5057-63 would hardly be bullish as this is the 90-day pause opening candle.