When markets are in balance, price tends to rotate within the range. The longer the balance lasts, the more persistent these back-and-forth rotations become. Last week was no exception—we began near the prior five-week balance lows and closed near the highs. We’re now in a six-week balance, and a sustained break in either direction should produce a significant move. For reference, think back to the multi-week and multi-month balance from January and February—its breakdown produced a similarly large move.

Coming off the bottom of the current range, ES ground steadily higher through key weekly levels, making higher daily highs and higher daily lows throughout the week. Setting aside intraday volatility, no prior day’s RTH low was taken out during RTH all week.

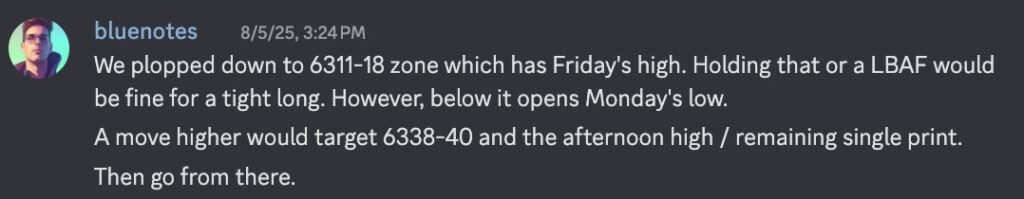

One of the cleanest setups was Tuesday evening’s LBAF/hold of 6311–6318, which delivered a 100-point move into Thursday morning’s London high. Thursday’s RTH low showed a similar pattern: a sell-off into the lows, followed by a sharp reversal in the final hour. On Friday, the 6374–6377 zone held beautifully, producing a 48-point move into the after-hours close.

Inside Week Dynamics

We ended the week with an inside week, so we’ll apply the same principles as an inside day. A LBAF or LAAF at either end targets the halfback, followed by potential continuation to the opposite side. Be prepared for the alternative a breakout with continuation in which case the target becomes the prior week’s high (multi-week balance top). or the prior week’s low if it’s a breakdown.

The key breakout level remains 6451, with 6468.5 ETH high as a secondary reference. Upside continuation from a clean break reasonably targets the 6560s, with an extended case for 6660–6680.

For the week ahead, I’ll use Friday’s range (6379.5–6418.75) as a guide. 6392–6396 and 6374–6377 are key pivots they protect the higher daily lows. Friday’s low sits just above 6374–6377, so a brief LBAF here would be acceptable. A sustained move below requires more caution.

Trading Higher

Friday’s high (inside week top) is 6418–6422, a critical zone for continuation higher. It’s also an LVN from two weeks ago and includes the July FOMC opening print. Acceptance above here targets 6431–6435 → 6451 (multi-week balance top) → with possible runners toward 6468 ETH ATH. Beyond that: 6483–6486 (July’s expected high) → 6504–6507.

Trading Lower

Losing 6374–6377 ends the streak of higher highs/lows. 6354–6357 becomes a must-hold. Acceptance below 6354–6357 could trigger a rapid liquidation through prior daily lows down to 6311–6316. A quick LBAF of 6354–6357 would still allow bulls a chance to reclaim 6375–6377 and negate weakness.

Bearish “Failed Break” Scenario

The most bearish outcome would be a failed upside break—especially if it takes out the 6468.5 ETH high but fails to print a convincing RTH high. Outside of a couple brief news-driven selloffs, bearish setups haven’t produced sustained downside, so seller conviction would need to be watched closely.

If a breakout above 6451 fails, 6392–6396 becomes the must-hold zone for bulls. A decisive failure here could lead to an aggressive drop, while hesitation or choppy selling after a failed breakout should be treated with skepticism.

This keeps the focus where it matters: reacting to the balance break—or failed break—and letting market structure guide the trade.

Live ES Chart: https://www.tradingview.com/chart/f8EEzTyy/

Expected Move: Week – 98pts, Monday – 48pts.