Again a short plan as I’m out and about. Will probably not do much this week other than find dips to buy. This week may play out like Thanksgiving – a slow grind. Maybe Santa rally started, but maybe it’s a quick trap as it’s usually closer to the end of December an a few days after the 1st. We shall see…

The week after contract roll is rather annoying with prior levels/profiles and what not. Day to day traders won’t care, everyone else it can be difficult to navigate. I would however, rely more on SPX/SPY for areas of interest until more price action is formed. For example, the single prints above us on SPX will land around ES 6920 or so. This is also near prior to ETH highs from earnings.

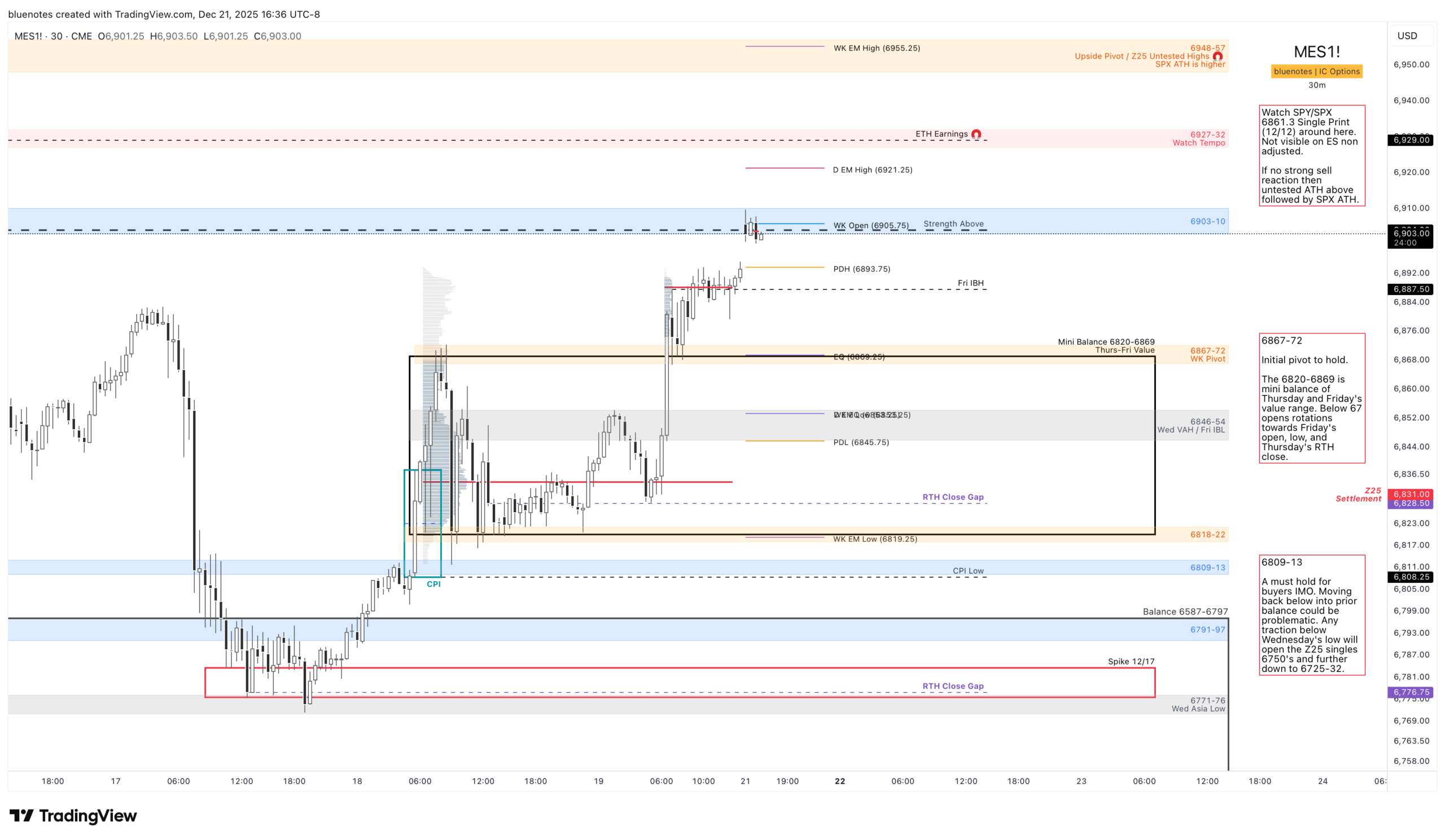

Main focus should be on the mini balance from Thursday/Friday’s value 6820-6869. Holding above, or a quick excursion to 6854-58 and reclaim 6872 should see 6903-10 where I would trim any longs. A LAAF of 6903-10 is possible or say 6927-32. Will need to observe how SPX handles that single print. If there’s no hard rejection, then ES ATH 6948-57 (non adjusted) should occur with SPX ATH to follow around ES 6977.

If WK Pivot 6867-72 fails to be supported, then a rotation back towards the other end of balance can happen with Friday’s low, Thursday’s RTH close, and CPI low. 6809-13 has been a buyer spot before, so it may hold yet again. However, we do have Wednesday’s low and the Asia low just below there that has not been tested yet including Wednesday’s spike. Further weakness can see 6750’s the Z25 singles, and 6725-32 and 6709-15. Buyers last stand will be down at 6677-87.

A quick reminder: ES has already rallied +182 points in December, and another ~120 points would trigger the first tier of exhaustion at 7008–7054. Z25 repaired its structure into 6725, marking contract lows just one session ahead of rollover. That level now becomes a Market Memory reference for H26 and a magnet when weakness re-appears.

Now consider this: if 6954 breaks higher during a holiday slow-grind, that move should not be treated as a structural breakout. Holiday price discovery combined with Contract rollover effect distorts character. To judge real acceptance, we must anchor back to SPX/Z25 structure, not raw H26 price. (Don’t we love contract roll?)

ES Live Chart: https://www.tradingview.com/chart/f8EEzTyy/