Both the daily and weekly timeframes are still pushing higher, while the monthly remains in balance. That backdrop helps explain the sharp response off the recent lows and the increasingly choppy behavior as we approach the highs. Until we see a decisive break out of this upper end of the range, it makes sense to stay cautious near the top. With FOMC this week, anything is on the table. QT has ended and the Fed is widely expected to cut rates, so the setup clearly favors the bulls. If they still can’t get anything meaningful going from here, that would speak volumes.

Monday’s gap down did take out the 11/28 Friday low in overnight trade, but during cash hours sellers never managed to break a prior day low. That’s an important nuance when gauging actual downside intent. It doesn’t mean sellers haven’t been active—we continue to see rallies sold, gap ups sold, breakouts faded, and even trend days higher ultimately sold into. I find that behavior notable given how close we are to the usual “Santa rally” window that many are counting on. If the market still cannot sustain a rally here, I view that as a deeply bearish signal heading into next year just as it was in a similar context last year.

From a structural standpoint, value gapped higher this past week, the 6809-13 zone held throughout including the low 6820’s, and cash-session sellers have not taken out a prior day low since the 11/21 swing low. There is nothing overtly bearish in price, yet I remain cautious. I sense fatigue from buyers, but as long as sellers are focused on selling strength rather than driving price through prior lows, the bulls technically remain in control. Practically, that suggests favoring longs on constructive pullbacks while being more conservative chasing strength, and staying alert to the risk of a sharper liquidation break if buyers finally lose their grip.

My primary concern is the relatively thin structure beneath us as we inch closer to retesting the ETH/RTH all-time highs. We did see some degree of consolidation this past week, but in my view a more clearly defined daily higher low would be a healthier foundation ahead of any serious attempt to break or extend those highs.

The Plan

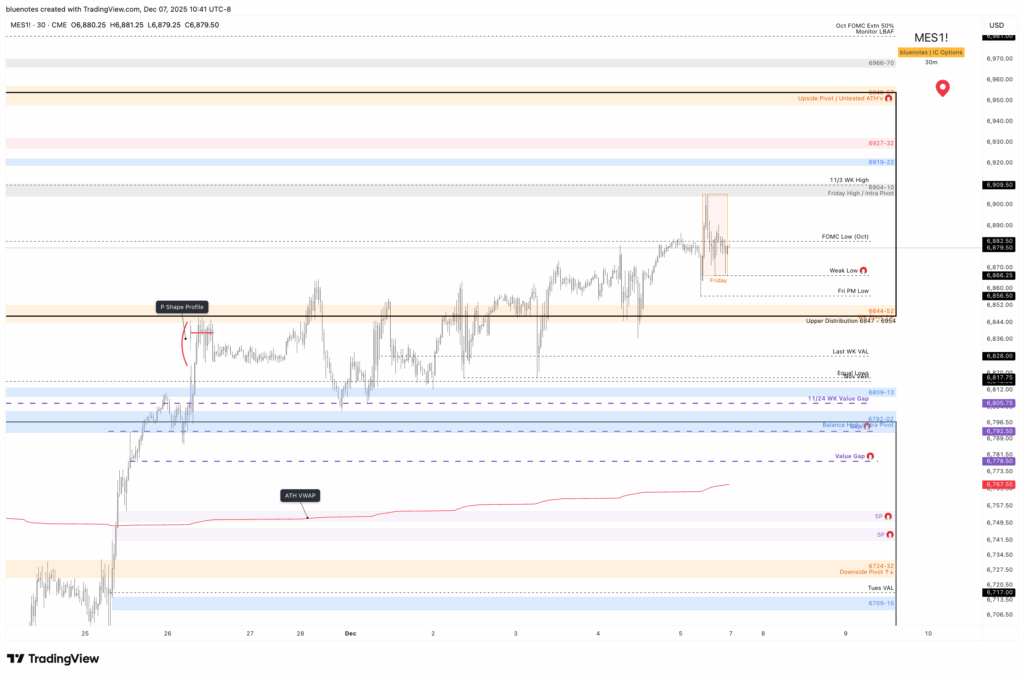

For this week, the weekly Pivot 6844-52 will be key again. This includes Thursday’s VAL, Thursday’s IBL, and the Upper Distribution low. Any test/hold of this area must find value moving higher and reclaim of Friday’s weak low 6866.25 and Thursday’s VAH.

Holding above the weekly pivot or a LBAF of Friday’s low targets Friday’s high followed by the untested ETH/RTH highs 6948-56. Still must be mindful of 6919-22 and 6927-32. Above Friday’s high continue to apply balance rules as this roughly aligns with the upper distribution halfback. Acceptance above 6957 targets 6966, 6981, 7004-14 and 7033-54

If traction holds below the weekly pivot and especially Friday’s low gets offered from below then last week’s (slow grind breakout) becomes at risk. Again this is not overly bearish on the higher timeframes and would resemble structure repair at this point with expectations of a higher daily low being found.

Below the WK pivot targets 6817.75, 6792.50 Gap, and 6778 Value Gap where I expect initiative buyers to appear. A deeper structure repair below 6778 targets the two sets of single prints 6750-55 and 6741.25-47. Failure to hold here moves us to the downside pivot 6724-32 where buyers must defend.

This is the final major event of the year, and one that can meaningfully shape the tone for the rest of December. Events are binary in nature and structure ultimately dictates the next leg, but events still matter in setting expectations and accelerating what structure is already hinting at.

Observe where ES parks itself on Wednesday ahead of the FOMC release, will be the first early clue for what’s next. Think of the 30m/60m FOMC release bar as your range and apply Balance Rules for your next directional trade.

Daily: OTFU (Ends at 6866)

Weekly: OTFU (Ends at 6812)

Monthly: 2Mth Balance

Weekly Pivot: 6844-6852

Upside Pivot: 6948-57

Downside Pivot: 6724-32

ES Live Chart: https://www.tradingview.com/chart/f8EEzTyy/