Welcome to 2026. For many participants, this first week often sets the tone for the year. The so-called Santa Rally turned out to be a mixed bag—depending on when (or if) you were involved. The Santa window officially closes on Monday, which raises the question: can bulls salvage it in a single session? So far, the answer hasn’t been encouraging. The Santa Rally window has been relatively weak, and that’s not a great sign.

Friday offered a good example. We saw an overnight rally into the open that was quickly and decisively sold. The sense of urgency from sellers returned, during the Santa window no less, which is not something you typically want to see if strength is genuine.

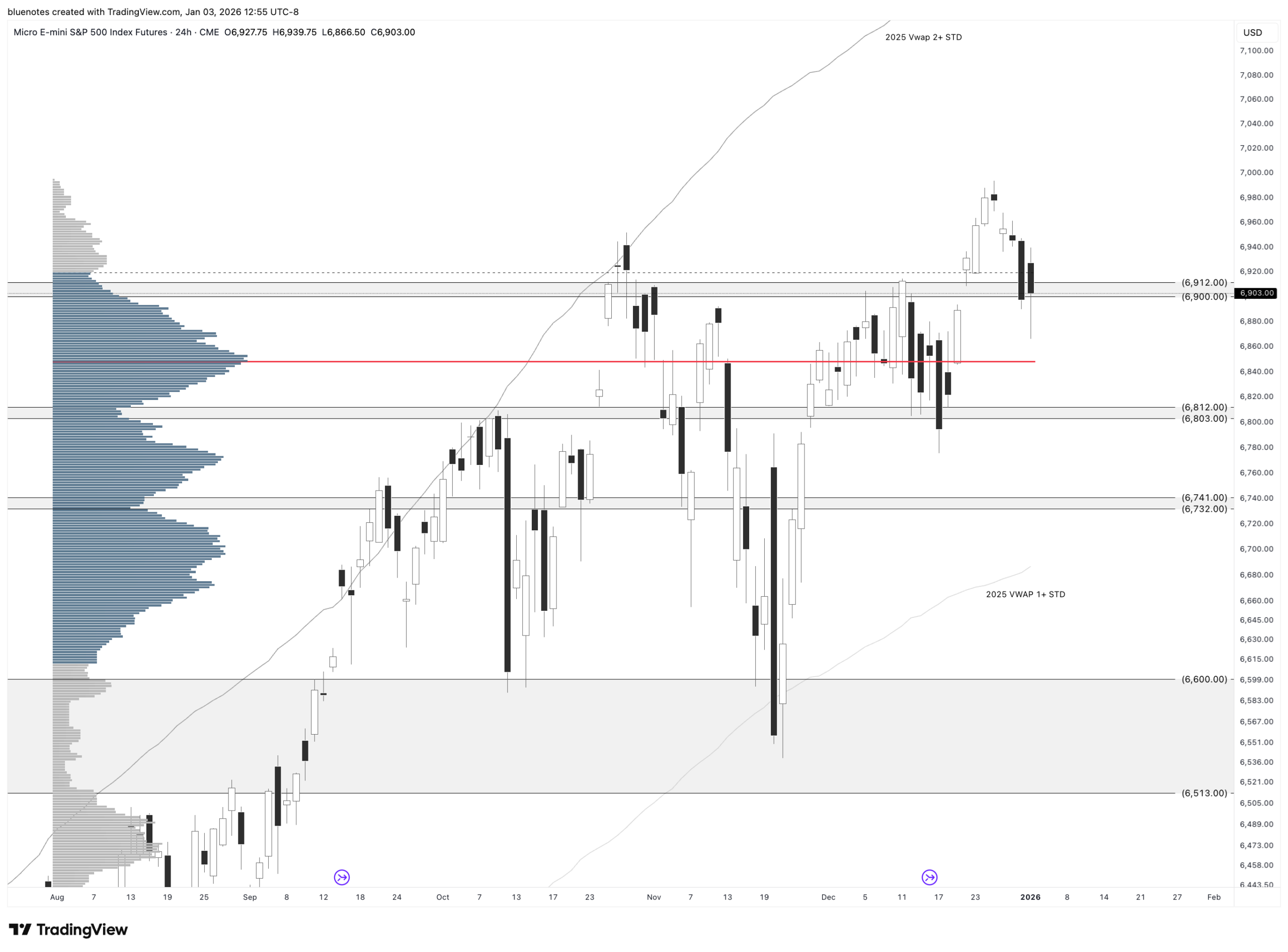

At present, we are trading within a three-month balance, with price sitting in the upper portion of that range. Objectively, this balance is neutral and can resolve in either direction. Given the broader trend that preceded it, it’s reasonable to lean toward an eventual upside resolution but that remains an assumption until price confirms it. To remove noise from the ES contract roll, I’ll reference SPX, where the balance range is effectively 6521.92 to 6920.34.

If you recall, we saw a similar setup toward the end of 2024: a multi-month balance that ultimately resolved lower around February OPEX and accelerated following a series of external catalysts. I’m not suggesting a repeat, but it’s worth keeping that precedent in the back of our minds.

The 2026 Prime multi-month balance will serve as a key framework for the year. Using SPX levels, the first 100% extensions project to approximately 6123 on the downside and 7318 on the upside. The balance itself spans roughly 400 points, with 200-point halfbacks. Notably, the 2025 low VWAP, which has not been tested since April’s higher low, remains an important longer-term reference.

Within this three-month balance sit several major structural levels that should be carried forward. These largely overlap with weekly reference levels and will continue to guide directional decisions.

Focus for the Week Ahead

Last week ended with a triple distribution lower. The weekly pivot held the upper distribution, while 6908-6911 marked the transition between the middle and lower distributions. For the coming week, I’ll use Friday’s range (6866.50-6939.75) as the primary guide.

Friday’s high sits within the prior weekly pivot (6936-6942), which also aligns with the lower boundary of the multi-day balance and the lower edge of last week’s upper distribution. Friday’s low aligns with the prior downside pivot and a small balance formed on December 18–19.

Trading Lower

Holding below 6908-6911 keeps price within last week’s lower distribution. More broadly, acceptance below 6900 opens the door to 6809-6813, which would complete a full rotation of the recent mini balance and move price below the 2025 POC (~6847).

The 6890-6894 zone includes Wednesday’s spike down and the bullish gap that was filled. This is the first meaningful area where buyers may attempt to defend before Friday’s low. Below that, there is residual demand from Friday around 6873-6878, where buyers may again attempt to protect the lows. Any defense here would need to reclaim 6890-6894 and ultimately 6908-6911 to be taken seriously.

Acceptance below 6866-6869 rotates the mini balance lower toward 6818-6822. The 2025 POC, December POC, and November VAH cluster around the halfback, all within the 6846-6854 zone. Acceptance below this halfback targets the downside pivot and then 6809-6813, a key area within the larger multi-month balance. The CPI low remains untested in this region, and the weekly expected low also sits nearby around 6817.

Further weakness opens the door to the prior balance 6587-6797, with a weekly reference at 6791-6797. This area protects the December 17 spike and the RTH close gap at 6776.75.

Trading Higher

Holding above 6908-6911, assuming no LAAF, targets Friday’s high and the multi-day balance low at 6936-6942. The former weekly level at 6922-6924 sits in between. There is some supply around 6927, so may not be a direct move toward 6936-6942.

The 6936-6942 zone is critical, as it represents the gateway back into last week’s upper distribution. Acceptance above targets 6948-6954, which includes last week’s POC and Wednesday’s high, followed by 6960-6962, the December 30 inside-day high. In this area, we encounter one of two RTH excesses that still need to be repaired.

Just above sits 6967-6969, followed by the gap fill and a value gap near 6974. Acceptance above the gap fill targets 6986-6988 and the weekly expected high around 6983, which also includes the remaining excess and the RTH/ETH all-time highs just overhead. Beyond that, upside references come in sequentially at 7012-7015 and 7027-7030. Notably, last week each upside push met responsive selling; acceptance above Friday’s high would be the first sign that this behavior is changing and could mark an end to the current one-time-framing-down (OTFD).

Final Thoughts

Sellers have a slight edge for now, given that price is hovering near the top of a multi-month balance. The counterpoint is that ES/SPX is coming off an all-time high and may simply be forming a higher low before attempting another upside break. Still, the market has been weak during a period when it typically should be strong, which keeps my guard up regarding any immediate upside resolution.

Being inside a three-month balance naturally invites two-way trade. In the near term, 6936-6942 is the level that keeps sellers in control. Until that is reclaimed with acceptance, upside attempts remain suspect. Add to that the current lack of clarity, and now the added variable of a strike against Venezuela, and it becomes important to see how markets respond, if at all, when trading resumes Sunday/Monday.

Money often likes conflict. The question is whether this particular catalyst is enough to meaningfully shift distribution. Until price answers that, it’s a matter of staying flexible, respecting the range, and letting the market prove its intent—one level at a time.

Expected Moves:

2026: 1161pts – (5732 / 8054)

Q1 (Jan-March): 487pts (6406 / 7380)

January: 234pts (6659 / 7127)

This Week: 83pts (6817 / 6983)

Monday: 33pts (6867 / 6933)

ES Shared Chart: https://www.tradingview.com/chart/f8EEzTyy/