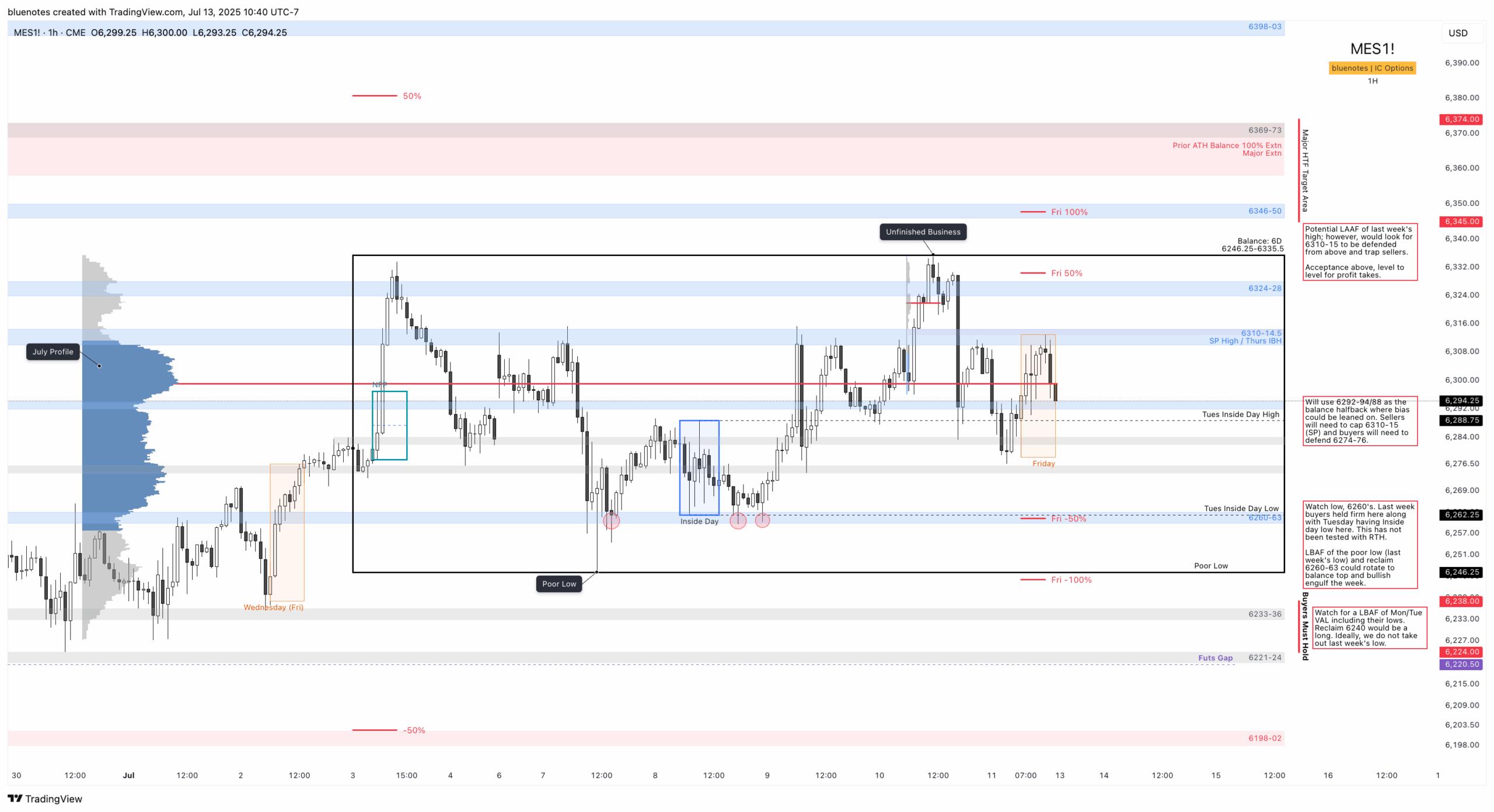

We’re now in 6 day balance (6246.25-6335.5). Both ends are targets with a poor low on the low and unfinished business on the high. The main objective for buyers is to defend the low and to keep OTFU on the weekly. If sellers gain the upper hand in the short term, the weekly can then go into balance which only expands our range. It would at this point not necessarily be bearish as buyers are not fully in trouble until much lower.

We were given additional reason to slightly cautious last week. NAAIM hit 100, and we hit the +2 standard deviation up from the 2024 VWAP which has been tracked since mid last year. We did see a pullback in NAAIM this past week as the index traded roughly sideways. However, we saw NQ put in a couple excess highs. As discussed during the week, this doesn’t necessarily mean we WILL see a meaningful pullback but the chances of it have significantly increased.

Value did gap higher last week on ES and is objectively bullish. As has been for a while now, longs on dips are favored until we find a short term downtrend. Even then, while shorts may be slightly favored intraday during a short time frame downtrend, we will still be monitoring for a daily higher low to get long. Until there is a proper shift in intermediate term structure this will remain the case.

For this week, I will use Friday’s range (6278.5-6313) as a guide to start off. Friday’s high marks the single print from Thursday including Thursday’s IBH. Will use 6310-14.5 for a weekly zone here as it also includes last Sunday’s open rejection and Monday’s pre market highs. On Friday, RTH had difficulty reclaiming the single print so any acceptance higher should see a rotation back to 6324-28 and balance top where we have unfinished business and relative equal highs. Further acceptance above, I would monitor 6346-50 which is the Friday 100% extension and then a major high time frame target area for me 6358-6373. Any pullback from here will need 6335 to hold as support.

As a starting pivot, 6292-94 should be monitored and is a July LVN. Friday’s RTH close is just above at the July POC but sold off a tad after hours into 6292-94 where Friday’s halfback is and 6 day balance halfback just below. I believe this spot can help determine who controls the week. If above, sellers will need to defend 6310-14 and the single print. If below, buyers will need to defend 6274-76 and especially 6260-63. With that said, because of the defense of the single print on Friday, sellers do have a very small window of opportunity here.

Friday’s low sits between two zones 6282-84 which held the initial tariff news on Thursday evening and 6274-76 which held London’s low. If Friday’s low does not hold, I would look towards 6260-63 as an area to focus on. This will be Friday’s -50% extension and Tuesday’s inside day low which was not tested for RTH. This was a very defended area early last week so I would expect buyers to pop in here. Below, we have the balance bottom and poor low. In a strong uptrend, taking out the poor low is not a priority, but any failed attempt at continuation from sellers would be a valid long. A LBAF of 6260-63 or the poor low that bases back above 60-63 could turn into a decent swing long that could potentially bullish engulf last week’s range.

If sellers do find traction below last week’s low, the 6233-6336 range sits just below. This is where buyers had established the lower edge during the 6/29 week. Like 6260-6262.5 from last week, I’ll assume that buyers still control the low 6230s until proven otherwise. This range protects the 6/29 week low and ES futures gap at 6220.50.

So, Above us and above balance top we look to take profits level to level and hold runners. Below 6260 and balance bottom, we monitor for a daily higher low to be found. For now, daily is in balance and weekly could soon become into balance. Until sellers establish value lower and end weekly OTFU, assume dips will be bought and rips will sold for profit takes. And even if sellers manage to put us into 2 or 3 week balance, It only expands our range for further rotations.

ES Live Chart: https://www.tradingview.com/chart/f8EEzTyy/

ES Expected Move: Week 89pts, Monday 39pts