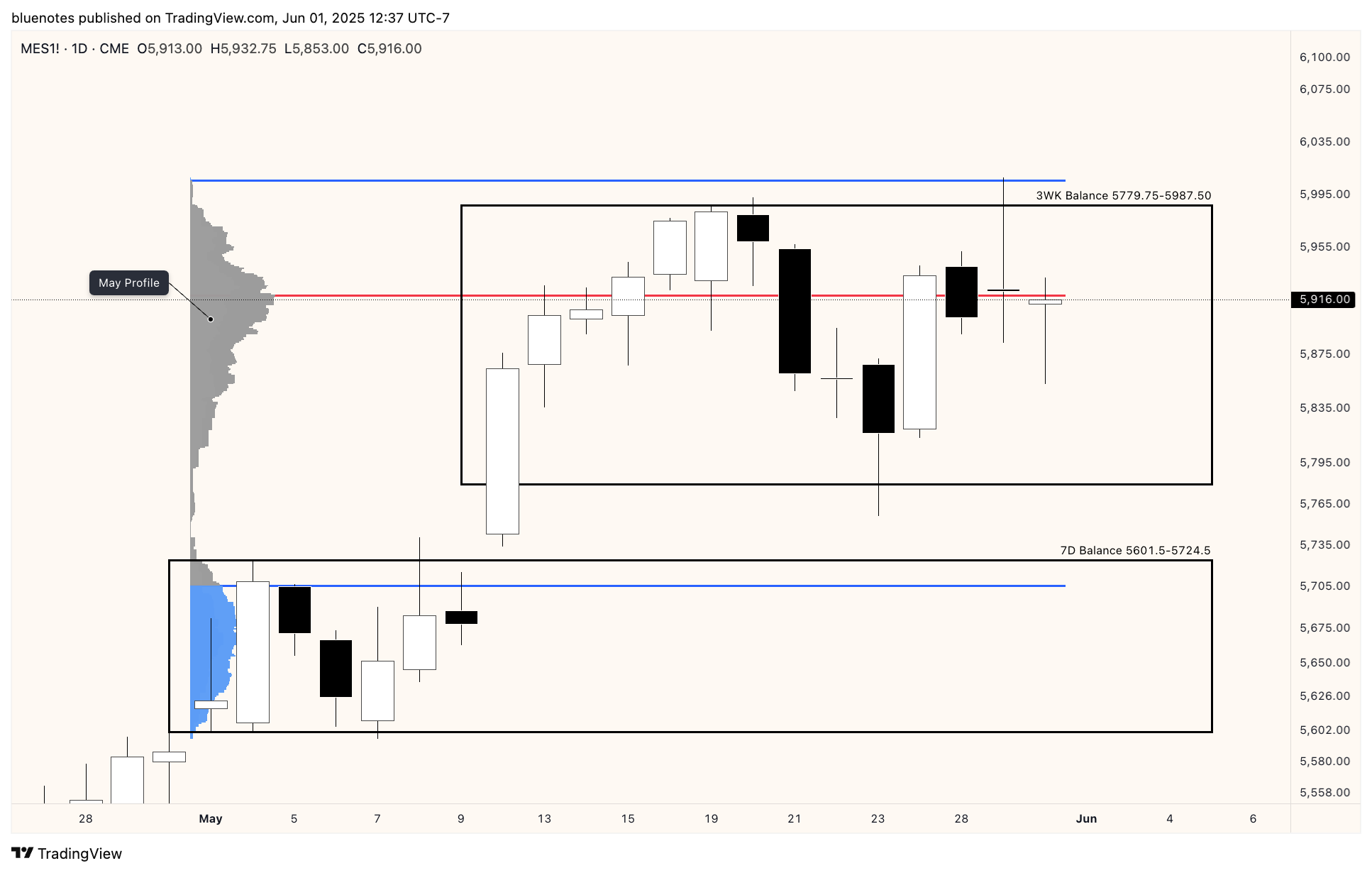

We’re now in 3-Week balance with both ends being swept in ETH. Weekend news immediately opened bid on last Sunday quickly moving up to the targets 5876 and 5887-95. Mid week in a dramatic fashion after NVDA ER which saw a nice bid, Trump was dealt a blow against his Tariff strategy and it was a non-stop bid to the balance top where sellers were waiting. London must have realized the Trump doesn’t follow any law or court and sold off back into Wednesday’s range where we sat for Thursday and Friday. Friday saw a morning drop nearly down to the weekly pivot but with end of month flows saw us move back into range but closed below 5920.

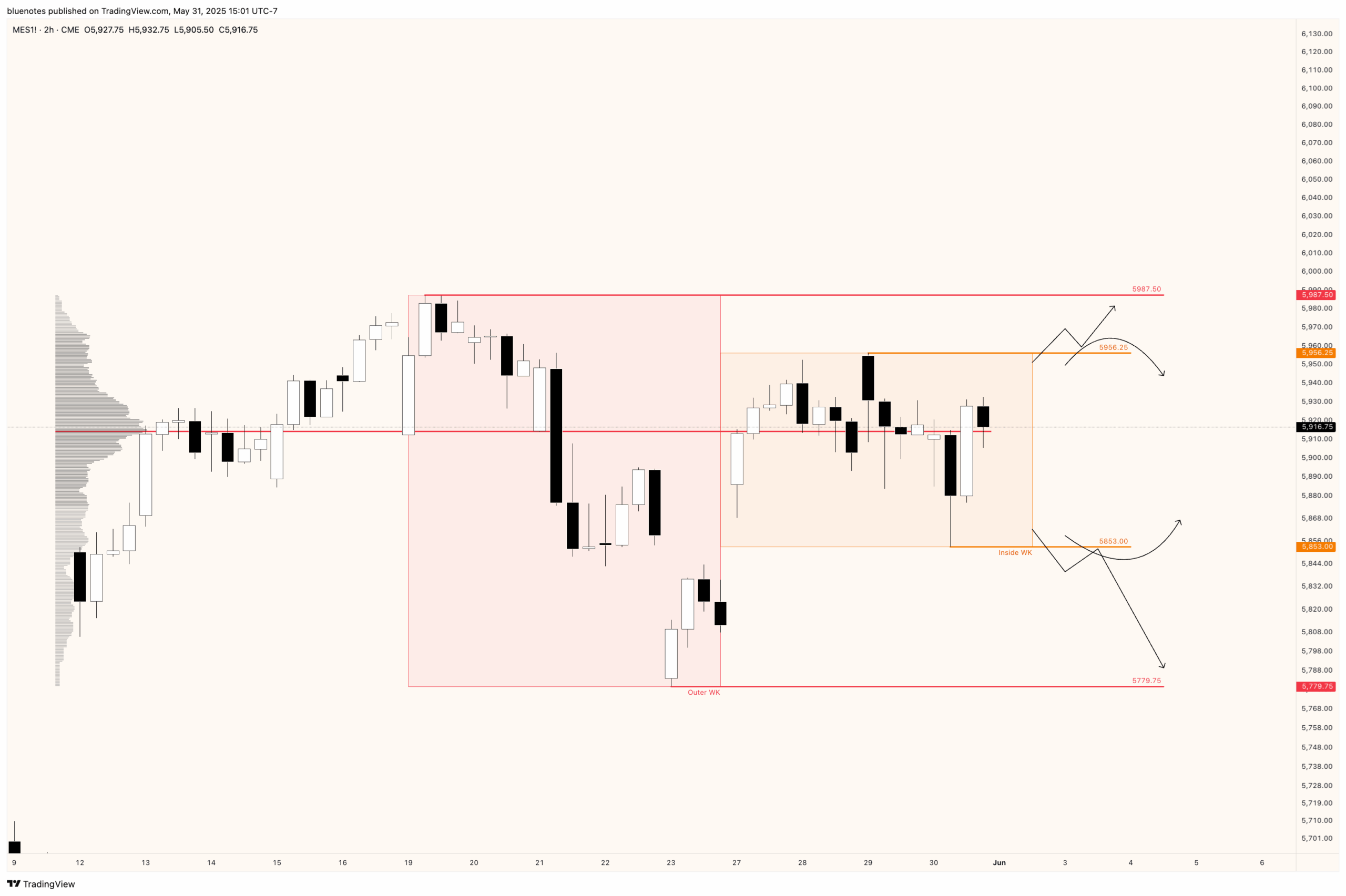

Not much has changed for levels and we continue to consolidate for the next big move. Friday’s close placed us right at the balance POC including last week’s POC. This week also ended as an inside week which makes this week straight forward. Last week’s key pivot was 5841-51 which marked the prior Friday’s high. We’ll keep it again for this week but slightly adjusted to 5843-53.

A LBAF (Look Below and Fail) of 5853 is a valid long including a LBAF of 5779.75. Same is true above with a LAAF (Look Above and Fail) of 5956.25 and or 5987.50. Apply balance rules for any reversion trade and target the halfback of the inside week followed by the opposite end.

If price breaks out of the 3-week balance, we target the 50% and 100% extensions. 6089-99, 6196-06 for upside and 5675-85, 5575-85 for downside. Engage at the edges and avoid trades between 5885-5940 as this is the chop zone. Above 5936-40 should give an early sign of higher prices to be reached. Below 5985-93 would be true for lower prices.

THE trade is objectively the break of this range with continuation and fading a failed break. We got a failed break Wednesday evening, but again it is far less clear given it did not take place during cash hours. Until the bull gap below is filled and then rejected from below, I must continue to lean with the buyers. An upside break (with continuation) of this range effectively guarantees new all-time highs, while a downside break (with continuation) keeps some drama in play.

The first day of the 7-day consolidation was May 1st which renders the ES May volume profile particularly relevant. Note how if price gets trapped back in the 7-day range below 5733.5-5741 then the bulk of the volume from May would be trapped (longs). Seeing this, makes the bull gap very important and must be held.

I’ve previously covered the potential full back test of 5733.5-5741 below the 5/23 low. We would now have 14+ days of long inventory trapped above but any inability from sellers to hold 5733.5-5741 from below is a long across multiple time frames. If sellers do win out, then rotation to the lower end of the 7 day balance is most likely.

We must remain caution for traps. With this consolidation, the large move is expected and probably happens this week. The multi-week hold here can definitely be distributive with longs exiting; however, it could simply be consolidation through time for the next leg higher. On the whole, there appears to be rot in the foundation. But until sellers actually do something meaningful, we continue to climb the wall of worry.