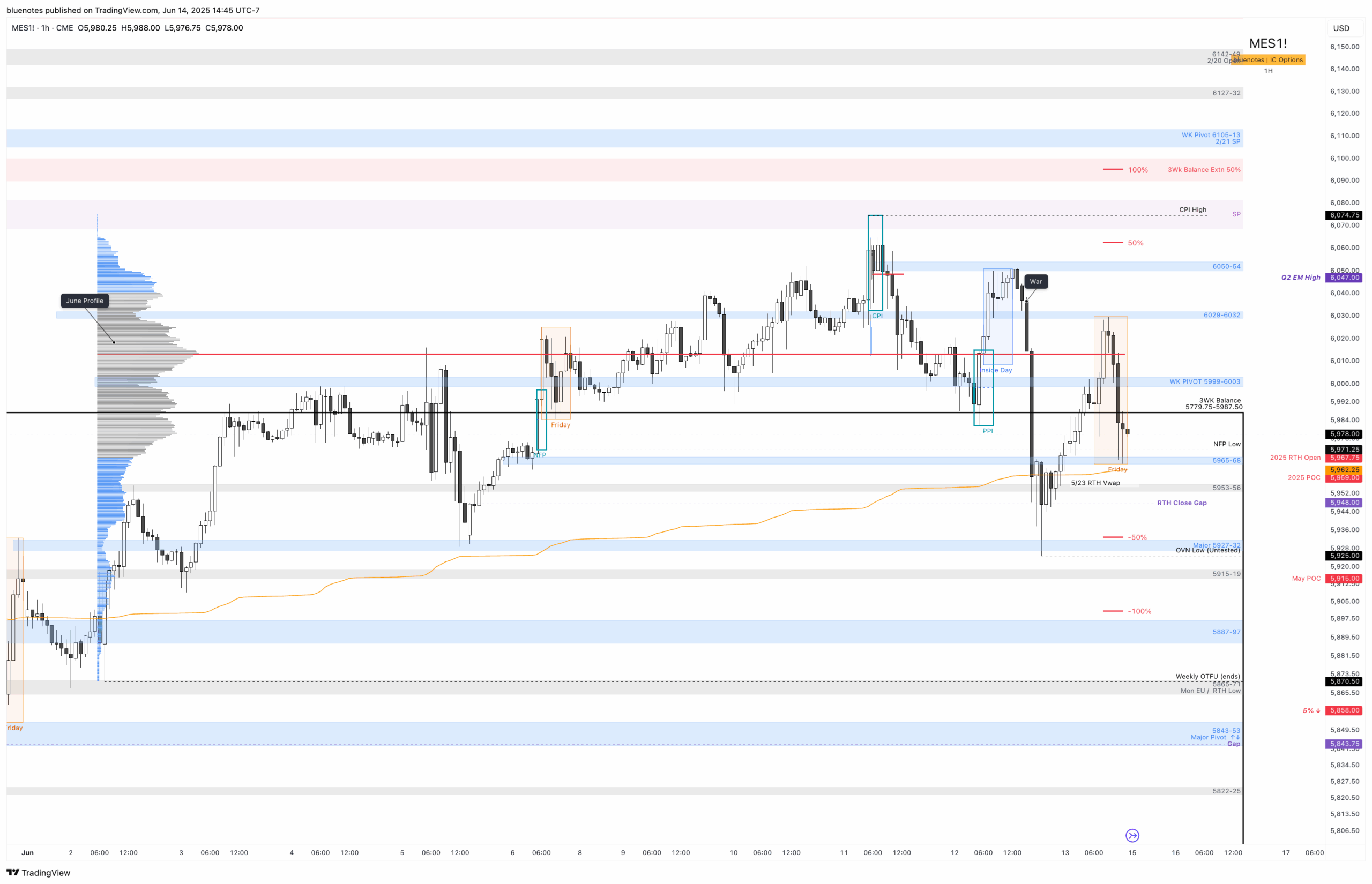

Last week saw us remain above the 3 week balance and building value above. 6060’s was mentioned about potential resistance and came in with CPI testing the single print. Wednesday morning I expressed concern that if buyers don’t hold and move higher on CPI then that would be a notable. China news was good and data was good as well, but they could not lift. From there during mid afternoon, a large seller entered and we sold over night going into PPI. Thursday ended as an inside day following war news that sold us down into 5927-32. 5965-68 was also on watch for a while and initially had potential. It was later used on reclaim including the Friday cash session low.

It is noteworthy that both NQ and ES pulled down into their 6/5 low on Thursday evening, which persisted into Friday. These levels are clearly pivotal areas to maintain going into this week. While we currently observe a short-term downtrend, bulls retain control on intermediate time frames. Consequently, it is reasonable (for the time being) to anticipate a downward trend in the market, with the objective of identifying a daily or weekly higher low. Major upcoming catalysts, such as escalating tensions in the Middle East and the Federal Reserve’s upcoming FOMC meeting, further contribute to this.

This week we have contract roll with TradingView switching over Monday evening. I will continue to use ESM2025 until Monday evening Once TradingView switches, I’ll be trading the new contract. I do not back adjust my charts so any levels you need would be adjusted for ESU2025 which is currently about 52pts. Make sure any trades after Wednesday you are using the new contract.

For this week, I will use 5999-6003 as our major weekly pivot for a few reasons. First this is slightly adjusted from 6004-08 used last week which provided a great deal of support. For now it serves as resistance of prior day lows and more importantly an LVN for June’s profile and the profile since the 3 Week balance began on May 12th. The entire profile VAH is here at 5999. This zone also includes Friday’s halfback.

Trading Above:

If 5999-6003 is reclaimed and holds, should rotate to Friday’s high and 6029-6032 weekly level. Further acceptance will see the remainder of the late time buyers on Thursday’s session get rescued up to 6050-54. There is a possibility that this then becomes defended by sellers with the CPI halfback there as well. Any selling position would then require back below 6029 and 5999 to be taken seriously. If price moves above 6050-54, the CPI high and single print (6068.75-6081.5) would be the next area of interest. Further acceptance above the single prints, I would target 6090’s as the 50% 3-week extension followed by 6105-13.

Trading Below:

Friday’s low includes the yearly open and 5965-68 weekly level. NFP low is also just above and was a slight higher low on the last hour of session. Trading below Friday’s low will ultimately put 5927-32 weekly zone and Thursday evenings low in play. This is a major level and lower LVN from June’s profile. 5953-56 is a minor zone and includes 6/1 week’s VAL and the inside week high. A LBAF of 5953-56 can be observed and would require Friday’s low reclaimed. However, I would still expect the overnight low to be tested. I will have eyes for a LBAF of 5927-32 and perhaps a quick excursion down to 5915-19.

Loosing 5927 will have quite a deal of trapped longs since June 3rd and represent a loss of a major level. From here I would expect a rotation down to 5887-97. Outside of an aggressive liquidation on news, I would look for 5887-5897 to hold or offer a quick LBAF. I would consider looking for longs then targeting 5915-19 and 5927-5932 and monitor for continuation from there. Below 5887-97 puts a previous weekly low in play including a gap fill.