Last week the important area was below Friday’s low and the 3 week balance top. The key was looking if sellers could even get traction below it from the US holiday session. Sunday we opened right at our 5965-68 zone and was quickly bid back to Friday’s low. On Monday for the NY cash session, the low was just above the 3 week balance top. Both of these points saw sellers lacking traction below allowing us to trend for the rest of the week.

With ES ATH including SPX and SPY, we should have little concern to be overly bearish. Again we must follow the trend until proven otherwise. There is no doubt that profit takes are happening as we saw on Friday with the aid of headlines; however, it was quickly bought back up. Traders who missed out on all or most of the move from lower are itching to catch in somewhere. The question now is, are they late to where they become trapped. In my opinion, we do have room higher to 6258-78 and the main extension being 6358-85; however, there will be weak hands up here allowing for potential quick liquidations lower, like we saw on Friday.

With that said, I want to be careful and picky about longs from here. Sweeps below prior lows and lower structure fills will provide the best entries for continuing higher. Buying a long on a breakout adds risk as new buyers may have weak hands. On the flip side, sellers need to show they mean business and not cover in 10 minutes. They must take out a prior day low ending OTFU on the daily. Then they must take out a prior week low to put the weekly back into balance. Both of these will give us a range to work with. Until then, we’re buying dips and cautious on rips.

The general plan remains “long until proven wrong.” We rallied 180 handles, so a pause and some consolidation would be reasonable, but positive flows in a shortened week generally mean upside continuation. We also end of month and end of quarter shenanigans this week.

Trading Higher

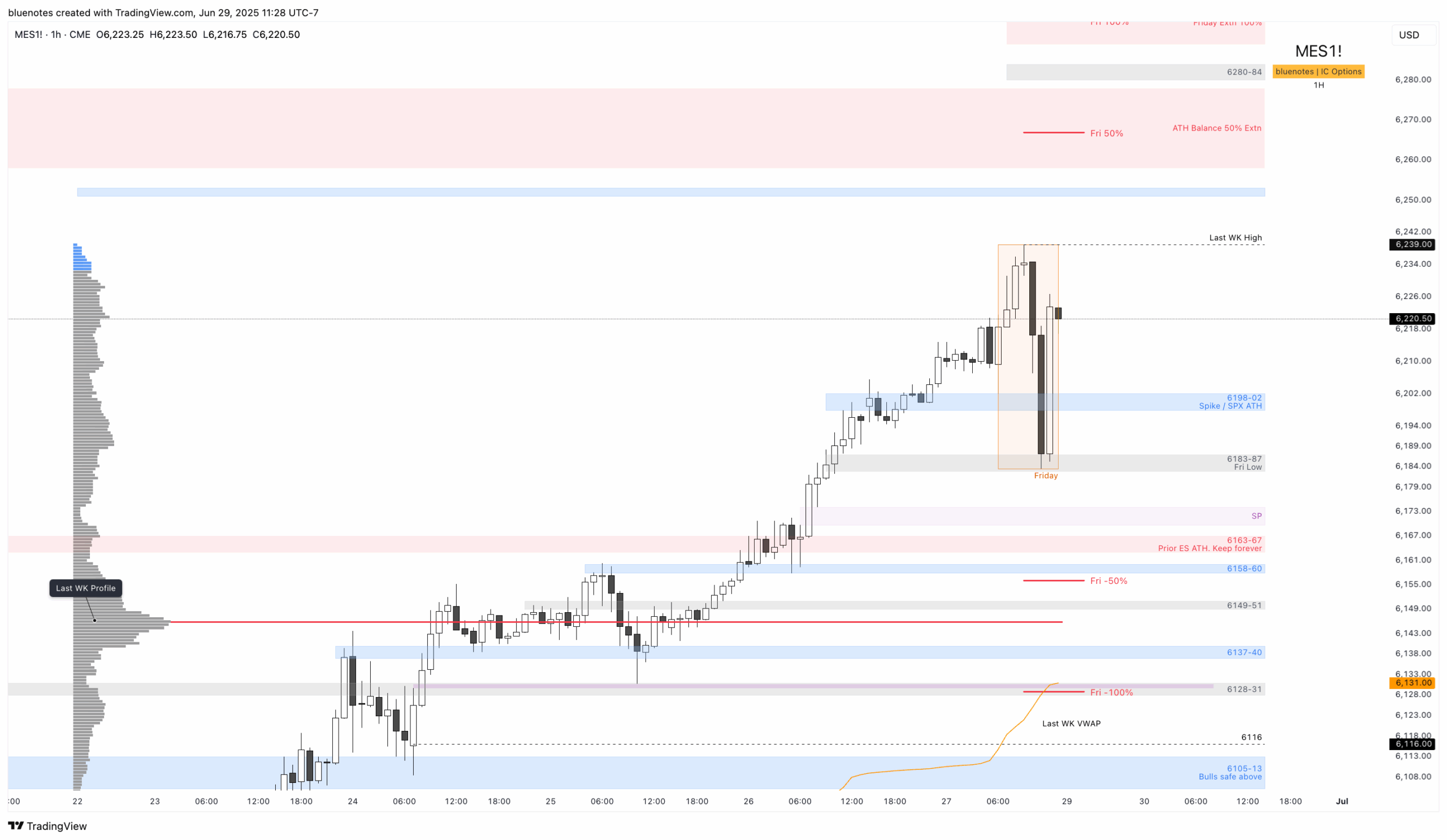

If we trade higher without taking out a prior day low, then there is little to discuss other than upside targets. Above Friday’s high, 6239, would look for 6251-53, upper 6260’s for the 50% extension of Friday’s range, 6280-84 and then 6289-6300 for the 100% extension of Friday’s range. Further acceptance 6313-16, 6328-33 and 6346-50 are on the cards including the major 100% extension from Jan/Feb balance 6358-6485.

Trading Lower

The 6198-6202 area can be used as a proxy for the SPX prior ATH. So any consolidation above 6198-6202 is bullish and is a long. It would also be a reasonable candidate for LBAF. I would also keep 6163-67 on your charts as this was the ES prior ATH (non adjusted).

If we do take out Friday’s low, then the single prints from 6/26 at 6169.75-6174.25 should be buyable. This would be the strongest response and will very likely be a long setup for Monday if seen. Should it reclaim of Friday’s low and especially 6198-6202 then we can assume a good chance for Friday’s high and above zones. Hold runners and let them work.

If we find price lower, I will be focused on 6158-60. This will be Thursday’s low and just above the 50% extension lower of Friday’s range. If this is lost, then I will be slightly cautious until back above it but ultimately will need Friday’s low reclaimed.

Below 6158 will put two prior day lows in jeopardy. This would put us into a short term down trend. Last week’s VPOC sit around 6146 with last week’s VWAP, perhaps reaching near that by Monday/Tuesday. Both of these would be reasonable targets for shorts. Further weakness, if seen would be 6137-40, 6128-31 (100% Friday extension lower and Feb OPEX breakdown) and 6105-13.

6105-6113 will serve as the major hold for buyers. Any consolidation above or a higher low on the daily should be considered bullish as this protects the gap halfback and gap fill from early last week.

ES Live Chart: https://www.tradingview.com/chart/f8EEzTyy/

ES Expected Move for this week

Weekly: 72pts

Monday: 38pts