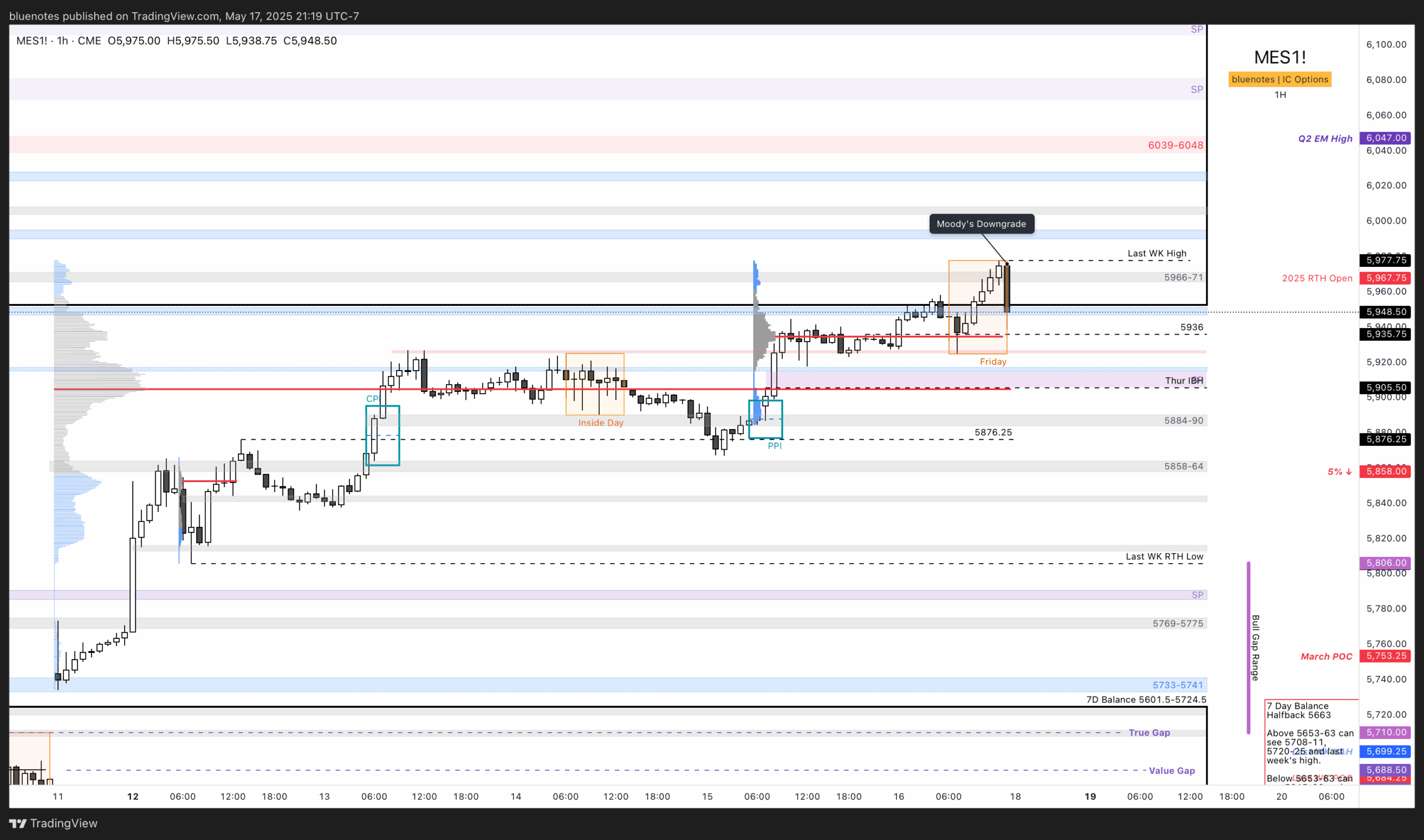

With a gap up and go from last weekend, we found price moving towards a prior area of major resistance marking the first attempt of the previous mult-week balance from ATH. Amazing that we dropped 20%+ only to reclaim 17% of that in a month. As with all good things, news managed to drop in after the market closed on Friday. This led to 35pt drop after hours closing at 5948.5. SPY on the other hand continued to sell which would look about 5915 on ES. Sunday night’s session and overall response to the downgrade from Moody will be key for the rest of the week.

Is it possible that this failure here could escalate into something severe? Certainly, but we’re not even close to that point yet. Regarding my perspective on the downgrade, I disagree with some of the “nothing burger” posts from well-known perma-bulls, and I also disagree with some of the “Doomers” who claim this is a catastrophic event. Regardless what everyone thinks, we’ll let the price dictate the story over the next couple of weeks if there’s a significant pullback.

Because of the sell off and potential further gap down, it will be difficult to plan initially especially for Monday. The bulk of the volume on the ES profile is closer to the middle of last week’s range say 5884-5948. Buyers won’t be under pressure until much lower.

Any consolidation above Monday’s low (last week’s RTH low) such as 5805-5835, maybe with quick excursions lower, will give us a multi day balance to work within and would favor the bulls. The bull gap below 5710-5805.75 should be protected; however, even a backtest of the 7-day balance (5601.5-5724.5) from the prior week consolidation would be quite bullish. with that said, bulls don’t want to get trapped back in that 7-day balance as loosing that entire range would be pretty bearish.

ES Live Chart: https://www.tradingview.com/chart/f8EEzTyy/

First and foremost, sellers must maintain price below the previous day’s low to begin daily balance. If a multi-day balance is broken to the downside, it would indicate a short-term downtrend. The next objective (or perhaps executed simultaneously if a significant gap down occurs) is to break down and sustain below a prior week’s low. This would give us a test of the bull gap and would simply bring the weekly into balance. We could establish a multi-day and multi-week balance before breaking either direction for a substantial move.

I’ll have to leave it to that and will see how we open. Difficult to plan ahead with a pending doom of death at the doorstep according the X.

Remarkable timing with this one though….