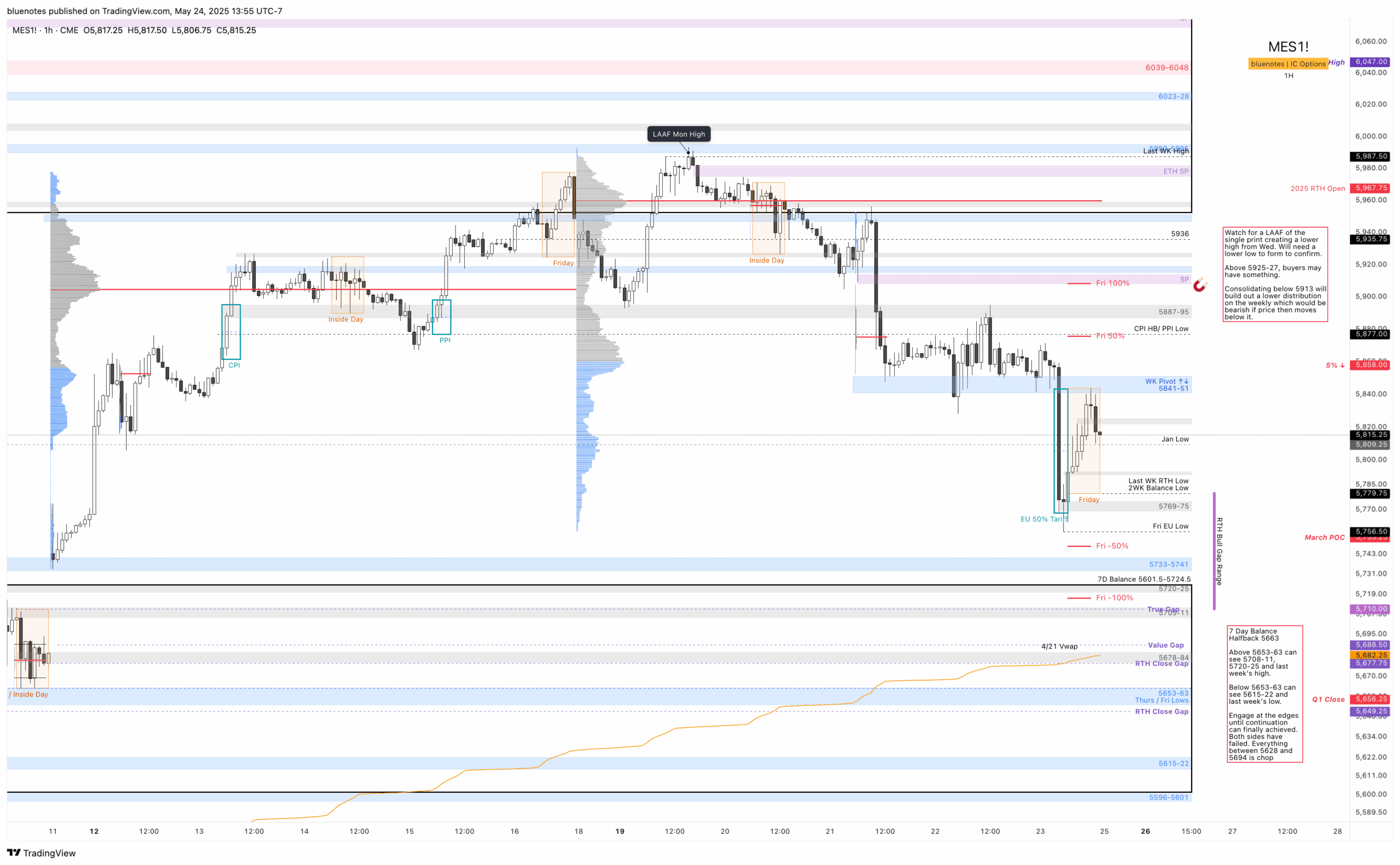

ES Live chart: https://www.tradingview.com/chart/f8EEzTyy/

ES finally found a short term high and entered at least a shorter timeframe downtrend. Throughout the week, three noticeable character changes were mentioned which kept us more defensive against longs using short hedges on SPY and/or shorts on ES and allowed shorts from failed breakouts such as failing IBH (Thursday and Friday).

- A move higher with a LAAF vs a move lower with a LBAF of the previous day high/low. While in a supported uptrend, the mentioned general rule is that it’s better to test lower first vs higher for bulls. This has been the case for a while until Monday night with Asia’s session. They moved above Monday’s RTH high and failed, thus created, at the time, early weakness. Tuesday followed as an inside day.

- Although not as important being ETH vs RTH, but 2 single prints were created in the London session with rejections from below. This happened Monday night and Tuesday night. The 2nd was cleaned up during Wednesday. RTH price is always priority over ETH; however, we must make notes of what happens on the other side of the pond.

- Acceptance below the previous Friday’s range. For a number of weeks, We continued to move above Friday’s range either from a quick excursion below it and reclaimed or never looking back. This week with the Wednesday end of day sell off, we started to close below last Friday’s range.

Now let’s look at a 4th character change. By Thursday we were developing a double distribution on the weekly with price spending more time on the lower end. From May 22nd:

For tomorrow. If we end up closing within the upper weekly distribution, then we would plan to side with buyers next week. If we close in the lower distribution, then lean with the sellers but cautiously as we have the bull gap below us (currently). So tomorrow, basically will set us up for what to do and tomorrow is when the bears need to step it up if they want this sell to happen.

This indeed happen and we closed within the lower weekly distribution suggesting a bearish lean into the coming week.

With this week taking out the low of the prior week (RTH) we ended OTFU (One Time Framing Up) on the weekly bringing it into a 2 week balance (5779.75-5987.5). We also held YTD VWAP and the August low VWAP marking the session lows, and we closed above the 200 daily sma.

We did see a multi-distribution week to the downside on ES this week which effectively filled in and around last week’s profile. It doesn’t need to be horribly bearish as it is just a 2-week technical balance as mentioned above. It does, however, suggest that sellers have control in the short term. For control of the intermediate term, the break of this 2-week range (with continuation) is what matters the most. It is very much worth noting that NQ did NOT take out last week’s low nor has it come close to the 200sma yet. As it has for the last few days, this complicates matters just a bit.

Will be using Friday’s range (5779.75-5843.75) as a guide for this week. With the notable character change #3 above, we need to continue to be observant if this continues to play out with acceptance lower by the end of the week. Friday’s low area is the 2 week balance low, the Trump Tariff announcement high from April 2nd, and just above March POC. This is also the current RTH low prior to the open bullish gap fill. Friday’s high marks a failed IBH and Thursday’s true gap fill rejection. Our early weekly pivot will be 5841-51.

If we break down with continuation we will most likely back test the 7 day balance and potentially fill the true gap at 5710. It is possible that we first get a LBAF (Look Below and Fail) of 5779.75 that either does or does not take out the Friday premarket low. We must respect the bull gap until it fails to hold and offered from below as resistance. Any reversal from the 7 day balance top including 5733-5741 to 5720-25 should be considered a long attempt with responsible buyers showing up. This could also turn into swing longs if Friday’s range is reclaimed.

If price becomes trapped below 5733-5741 and accepted back below the 7 day balance top then balance rules apply as a failed breakout of balance. This targets the halfback and next weekly zone 5653-63 followed by balance bottom at 5601.5 but may only reach 5615-22. Here I would again be looking for longs with a look below and fail and reclaim of 5615-22. There is potential for this being a decent bear trap and could fully rotate back to the top of 7 day balance.

For higher, will need acceptance above the weekly pivot 5841-51. This marks Friday’s high including Wednesday’s and Thursday’s lows. If you also tracked the EU 50% Tariff tweet from Friday pre-market, then that event candle high is there as well. Any failure to reclaim Friday’s high and 5841-51 is technically bearish consolidation and favors lower prices (reference character change #4).

Above 5841-5851 starts to look quite good for bulls after a hold of the 200 daily sma. I would expect to see at least 5876 (Friday’s 50% extension) and a test of the current structural lower high at 5887-5895. Above 5895 opens a test of the single print 5907.75-14 which is also Friday’s 100% extension.

Based on this week’s profile it is certainly possible that we get a LAAF of 5887-95, perhaps from the single print and end up with a retest of 5841-5851. A hold of 5841-5851 from above would be a fair swing long attempt as it would represent a shift in short term structure back in alignment with the main trend. Acceptance above 5915-19 should see a retest of 5947-51.

It is a shortened trading week as Monday is a US holiday. Futures will open as normal Sunday night and close early on Monday.

ES Weekly Expected Move: 119pts

ES Mon-Tuesday Expected Move: 60pts

Tuesday: Durable Goods

Wednesday: FOMC Minutes

Thursday: GDP / Jobless Claims

Friday: PCE

Fed speeches throughout the week.