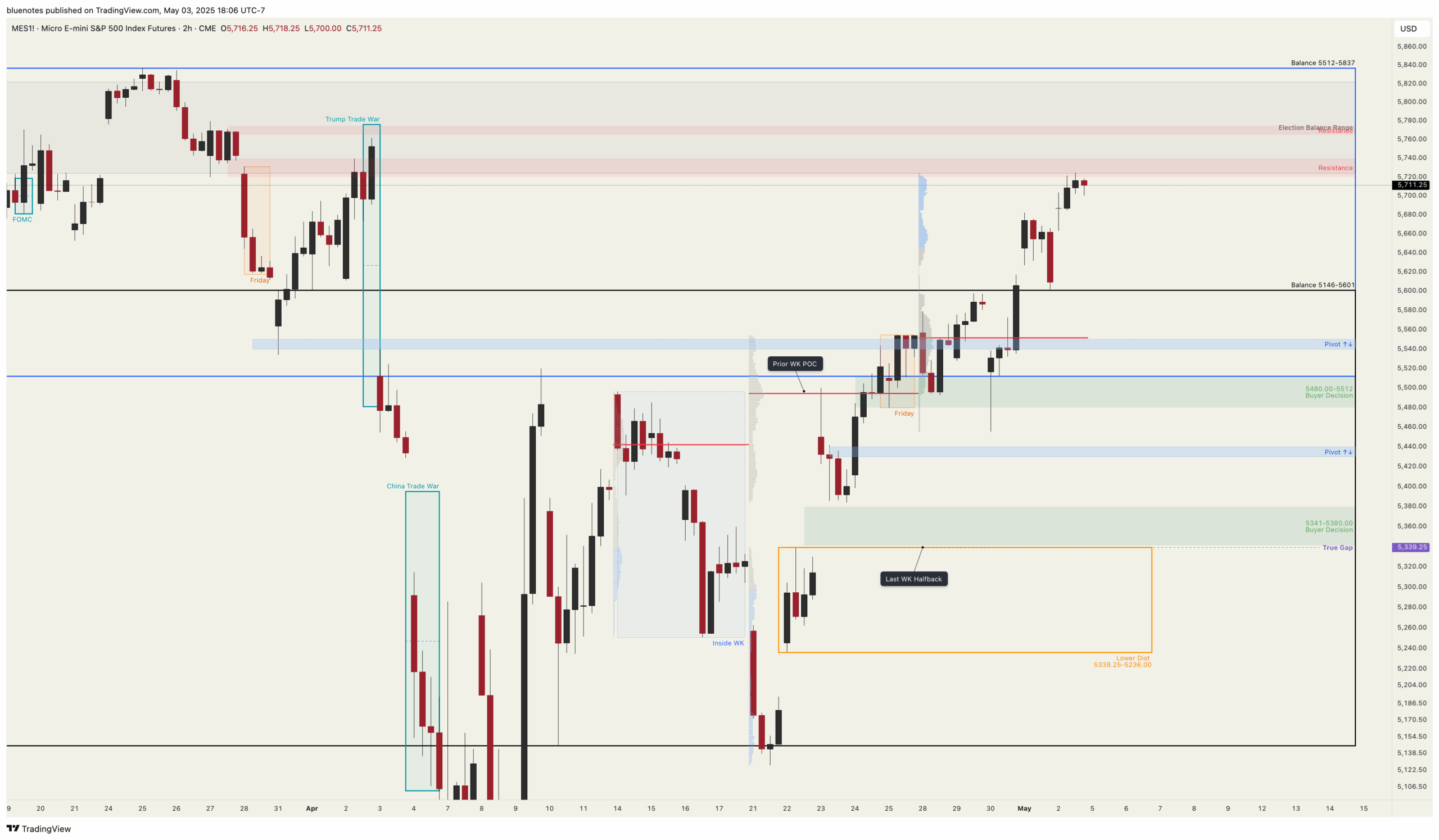

We’re coming up to a pivotal area. The 5724.25-5822 is a multi day balance going into the election. This also happens to include the Trump Tariff Announcement along with the upper side being the multi week and month balance from ATH.

On Wednesday, we came down to Friday’s low and further sold into the single print that was left from April 24th. No time was spent there and we reclaimed 5462-65 and 5474-80 which was also Friday’s low. From there non stop and ended with a spike up on Wednesday’s close. No question this was a powerful move that took out late sellers. Thursday’s close saw a sell with AMZN and APPL and came into the 5616 area just above the spike top where I was looking to long. This occurred after hours and just before China made news which saw price retrace all of Thursday’s ending sell.

From last week’s plan:

For this week, if we are holding above last week’s high 5554.5 then the breakout is clearly sustained. Holding above 5540.5 I would consider it sustained, and above 5520-5525 I would consider it fine and probably sustained. Any kind of failed break higher will need to take out these spots and ultimately find persistent traction below Friday’s low 5480.

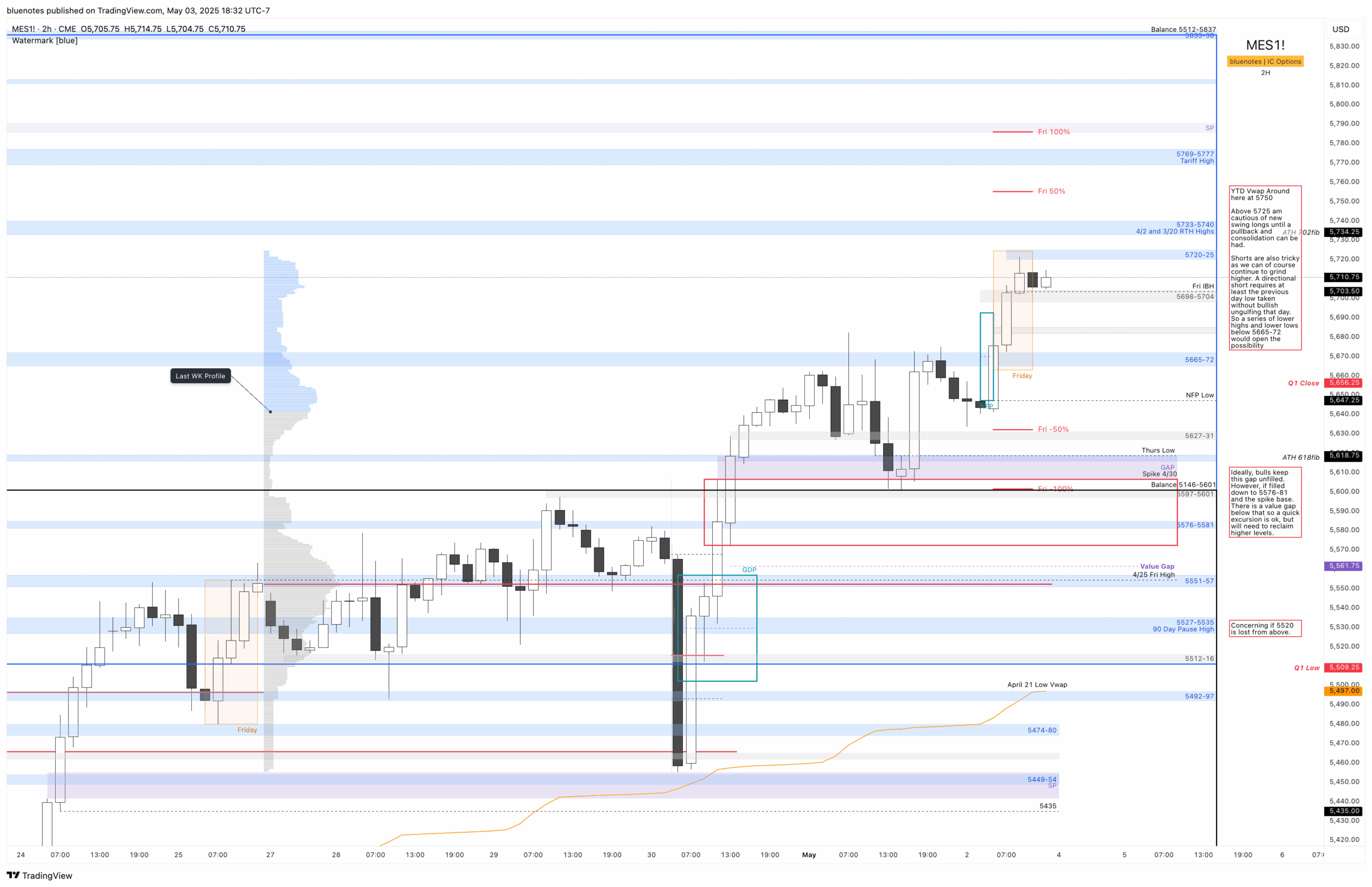

Friday’s high was 5724.50. This is definitely not a spot I would feel comfortable being naked long. Accordingly, I took profit on a number of equity positions that I’ve held from last month and added some hedges.

Keep in mind, while we remain in an uptrend, the strength and importance of an upside level does not warrant an automatic short. As of now I would be planning to buy a higher low while holding runners on my hedge and any active shorts I may take. We have not (yet) seen data materially deteriorate – NFP was actually quite good, and GDP wasn’t as bad. Earnings were “okay” but keep in mind “Liberation Day” wasn’t until after the quarter was closed. A number of people have recently pointed out that this looks just like 2022. It is a long year and as always I’ll continue to keep an open mind on both sides and respect what price is telling me.

Generally, if we reclaim and hold above this range, then new highs are a real possibility. For ES this would be back above 5840 give or take (Balance 5512-5837). We could still potentially fail 5930’s and fall back below 5740 but holding 5840s from above would be a strong look.

If we trade lower, the first major area of interest is the current bull gap we have between Wednesday’s high and Thursday’s low. For ES this ranges 5606.75 to 5618.75. It would be ideal for bulls to preserve this bull gap and not allow it to fill. However, bulls may still be ok above 5576-5580.5. There is an LVN there from last week. This was also my main area to long prior to to Friday.

Below 5576 opens the value gap at 5561.75 and Friday’s high from April 25th. Last week’s POC sits here along with GDP event candle top. Any failure to reclaim 5576-81 allows rotation down into these areas including 5527-5535. Giving back this range break would be a poor move for the bulls, and I would expect to see a liquidation of late longs if we are trapped back below 5492-97. Note that the April 21 low vwap is currently around 5500.

If we trade higher, the 5733-5740 zone can be stiff resistance including just above it with the ATH vwap currently around 5750. However, acceptance above opens the test of 5769-5777 and the Tariff Announcement high. Sustaining above will be quite bullish. Would still need to be aware of a potential LAAF here. Above April’s high there is a single print at 5785.5-5790.75 which is also Friday’s 100% extension. Further acceptance will give the 5811-13 test from the multi-week ATH balance low.

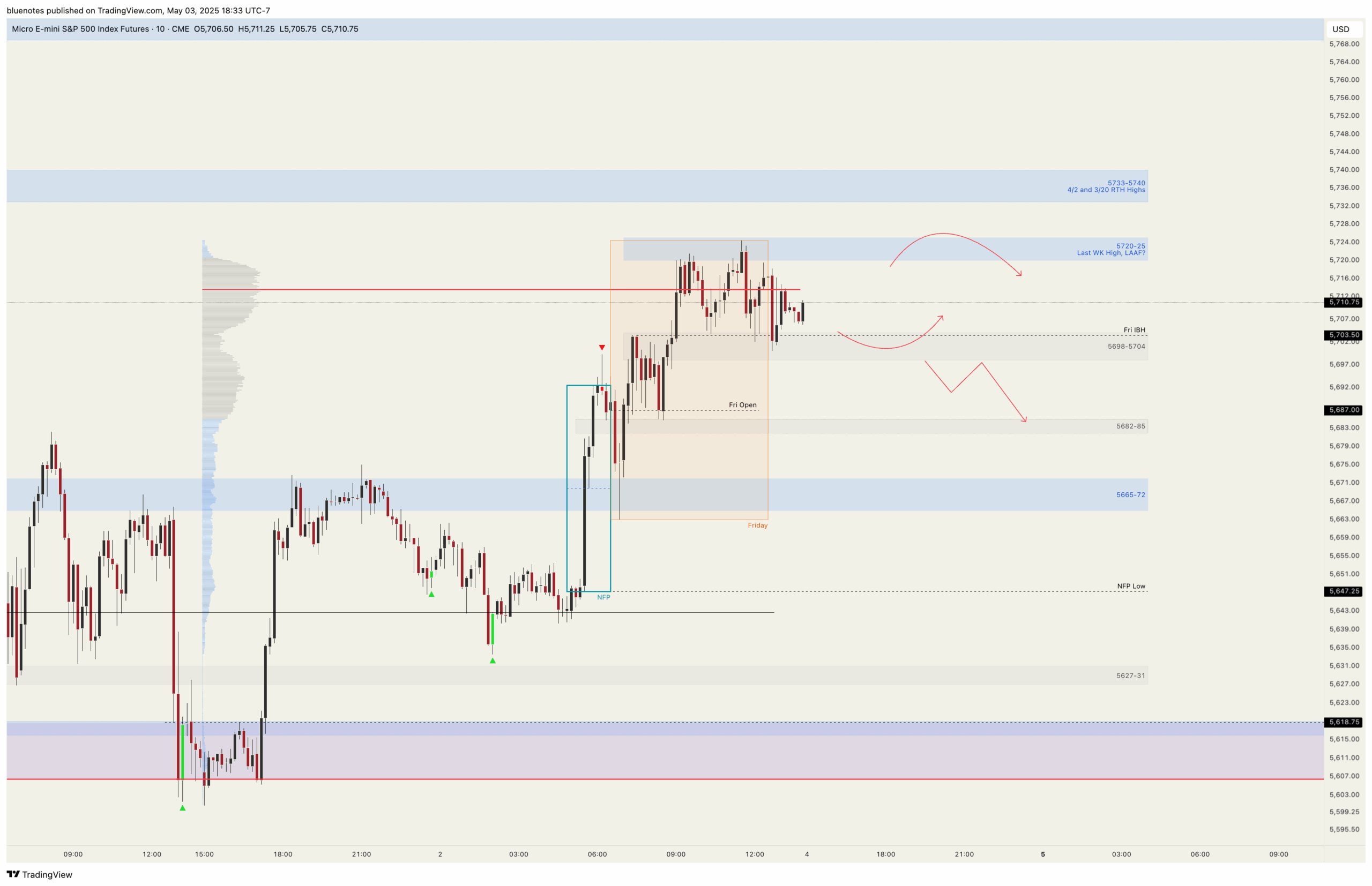

For Monday I will be looking to play against the upper range that was established Friday between 5698-5704 and 5720-25. A look below and fail and or look above and fail of either end can see rotation to the opposite side. If the lower end is swept first can potentially see it go to 5720 and Friday’s high. Will hold a runner for higher prices if it can. If we get trapped below 5698-5704, may end up down to 5682-85 where I may look for a long. This was an area from Friday that saw a 30 min LBAF of Friday’s open. So a long try here is completely doable. It would need to reclaim 5704 and Friday’s IBH. If continued selling below 5682-85 then 5665-72 is in the cards along with Friday’s low.