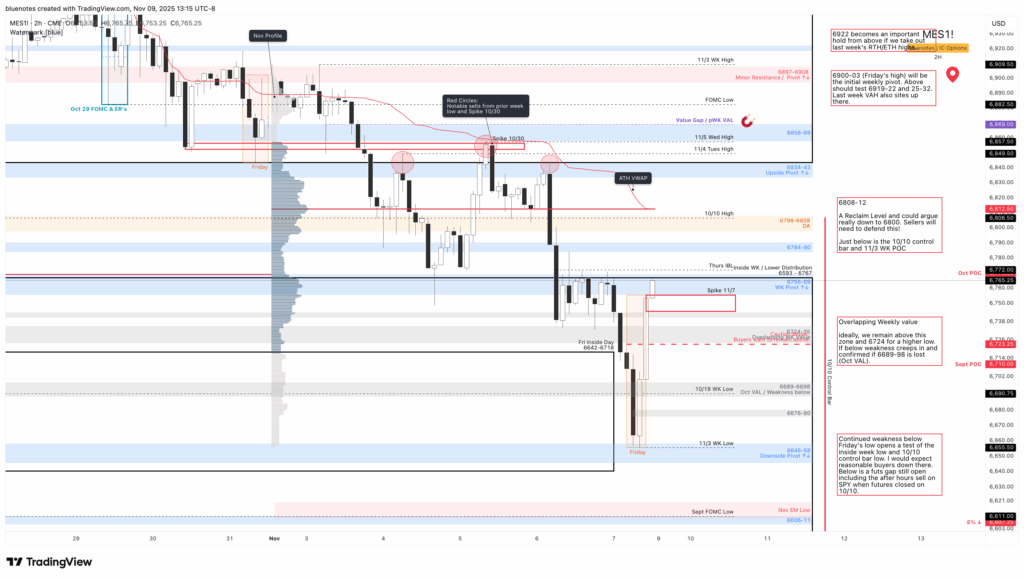

This past week’s breakdown was built on value migrating below the prior week’s VAL (6,868). That shift lower was confirmed as the remainder of the week continued to build value and price beneath the upper distribution (6,840s), ultimately leaving OTFU (one-time framing up) across both the daily and weekly timeframes. The key takeaway heading into this week is to watch whether we see continuation lower or whether last week’s move turns out to be a trap.

Based on last week’s structural development, sellers currently have control. This gives them their best opportunity yet to push for a clean-up move below recent levels — unless, of course, a reversal auction is sparked by a catalyst such as a government reopening or CPI data. Friday’s mid-day rally off the lows does suggest that buyers have a window early in the week to confirm a squeeze higher if they can defend it.

Primary focus:

6,756–6,769 (Weekly Pivot Zone) — This area aligns with the balance high, Friday’s high, and weekly VAL, making it a critical level for direction. Reclaiming and holding above this pivot would shift near-term control back to buyers, targeting 6,784–6,790 and 6,798–6,808.

The 6,798–6,808 zone will be especially important going forward. It represents:

- Thursday’s breakdown area

- October POC

- Last Tuesday/Wednesday merged VAL

- Prior support/resistance

- Approximate ATH VWAP

- The top of the prior five-week balance

Additionally, 6,784–6,790 aligns with the delayed release of October CPI lows and last Thursday’s afternoon rally high, adding more significance to that range.

Acceptance above 6,808 opens the door toward the upside pivot at 6,834–6,843, which represents the upper balance low. Beyond that, price would work on repairing structure into the value gap at 6,858–6,869, followed by resistance at 6,897–6,908.

Between these two balance zones, expect choppy, indecisive trade as participants determine which edge of balance will hold.

- Buyers will want to see value migrate higher (forming a higher low).

- Sellers will aim for value to migrate lower (forming a lower high).

Downside Scenarios

Holding below the weekly pivot (6,756–6,769) and accepting below 6,724–6,735 keeps sellers in control and confirms continued weakness. A break below these levels targets October VAL (6,689–6,698), with follow-through likely down to Friday’s low.

Acceptance below the downside pivot (Friday’s low, 6,656–6,658) would confirm trapped buyers above and strengthen the case for a deeper liquidation.

It’s crucial for buyers to hold above 6,725 to preserve the momentum from Friday’s rally. When a strong short-covering move isn’t defended, it often sets up a sharper secondary sell program.

Below Friday’s low opens the path to the balance low at 6,592. Also note that the November expected low sits in the 6,610–6,620 region — aligning with the September FOMC low and marking roughly a 5% drawdown from the ETH all-time high.

Thoughts:

It’s reasonable to assume the market is at least pricing in or speculating on a resolution to the government shutdown this weekend or soon. A reopening would allow the Treasury to spend down the TGA (liquidity-positive for risk assets) and get federal workers — and other affected sectors — back online. For example, we’ve already seen airline disruptions tied to the shutdown, highlighting the real economic impact.

Whether or not a resolution happens this weekend, the market’s reaction afterward will be critical to monitor. If the shutdown ends, the market effectively has no excuse not to rally toward meaningful new highs into year-end and January.

ES Shared Chart: https://www.tradingview.com/chart/f8EEzTyy/