Will have to make this a brief as I found myself out of town.

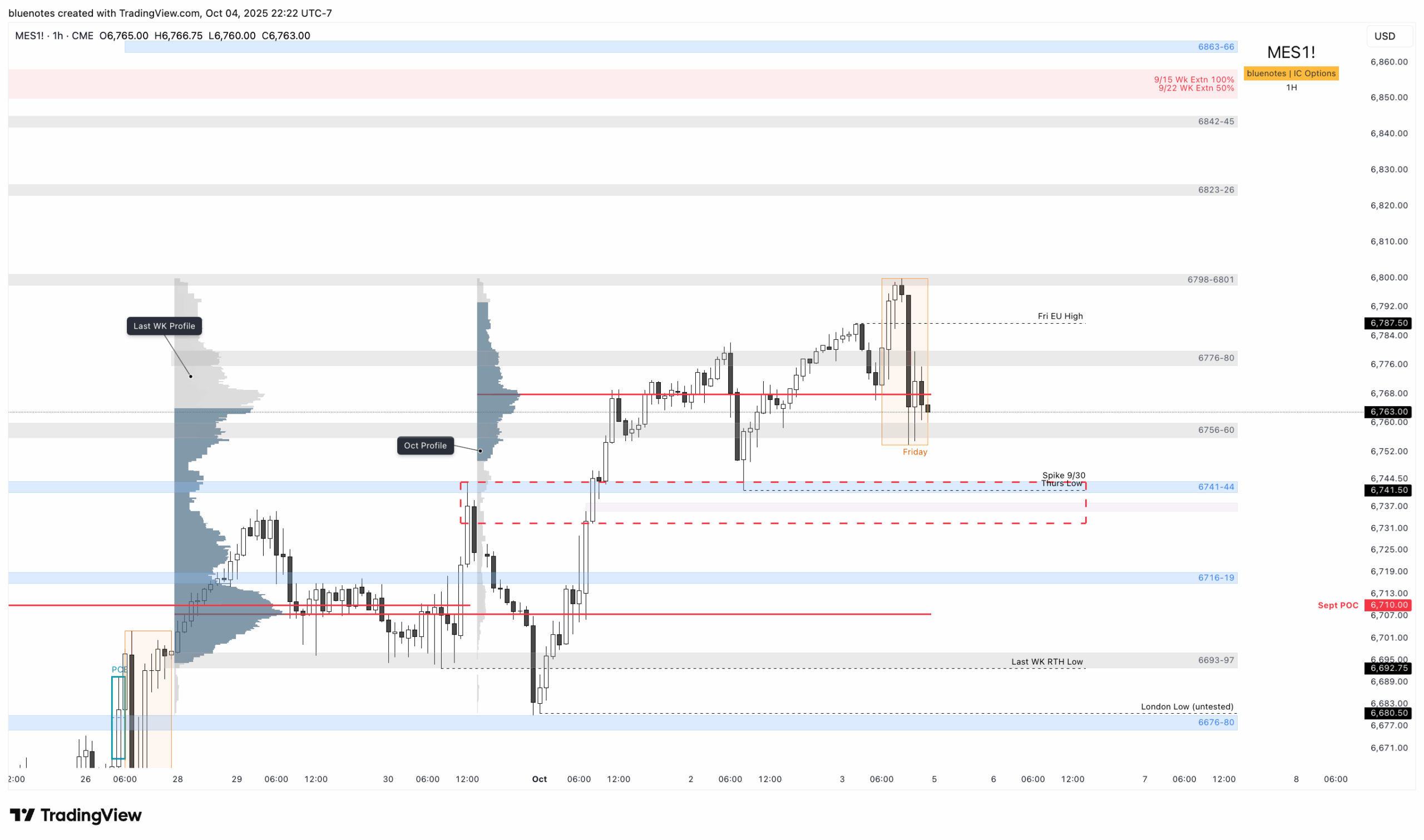

Last week’s two key long setups 6676–6680 (Wednesday ETH) and 6741–6744 (Thursday RTH) offered excellent opportunities, with the primary target being the ETH all-time high cleanup.

From last week:

If we fail to hold above 6700–6706, I’ll look for 6676–80 to act as support, with potential for a quick LBAF.

Holding above 6719–21 supports the bulls’ objective of cleaning up the poor ATH and pushing to new highs.

From a broader perspective, we’ll see a meaningful shift in tone only when sellers can establish a lower daily high followed by a lower low. Until that happens, I continue to view liquidation breaks as buying opportunities.

Last week formed a double distribution, anchored by the 6741–6744 weekly level and a remaining single print (6735.75–6738) both part of the September 30th spike up. This structure warrants some caution, especially since the NQ already broke a prior day’s low. If ES takes out Thursday’s low at 6741.5, especially with NQ confirming, it would mark a short-term downtrend.

Acceptance below 6741, without a look below and fail (LBAF) setup of the single print, opens the door to 6716–6719 a critical support zone for buyers. A break below 6716 exposes last week’s RTH low and an untested EU low at 6680.50.

On the upside, holding 6756–6760 (even briefly dipping below in a quick LBAF) keeps the structure constructive, targeting 6776–6780 followed by Friday’s high. Sustained trade above 6798–6801 remains straightforward and would aim for the weekly extensions at the 6850s (Sept 22 50% and Sept 15 100%).

Looking ahead to Sunday and Monday, my focus will be on whether sellers can finally break the structure lower. For buyers, it’s actually advantageous to test lower first before pressing higher. If sellers fail to gain traction below Friday’s low, that would favor a long setup. A LBAF of Friday’s low that stabilizes above 6756–6760 should rotate back toward 6776–6780.

For sellers, watch if 6776–6780 continues to cap rallies as this area was resistance both Thursday pre-market and again Friday afternoon, aligning with Friday’s halfback. It’s also notable that 6787.5 (Friday’s EU high) could bring in responsive sellers. Any short setups from that zone would need to move back below 6776–6780, targeting Friday’s low for confirmation.

ES Live Chart: https://www.tradingview.com/chart/f8EEzTyy/